Economy Watch: Interest Rates Rise, So Does Inflation

Investors will continue to find the search for yield a dominant feature of 2017 and beyond.

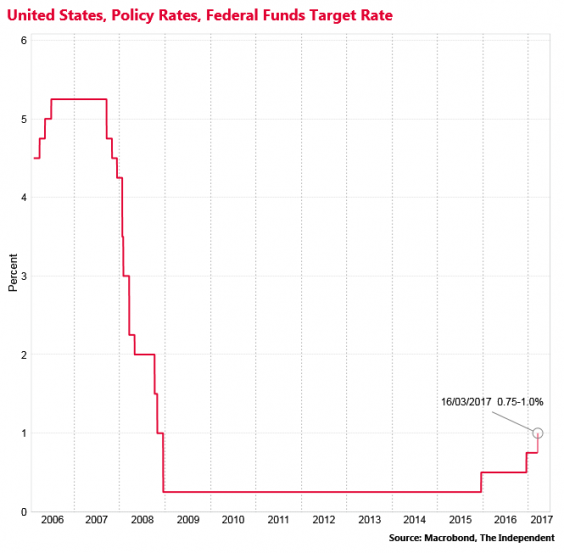

“In view of realized and expected labor market conditions and inflation, the Committee chose to raise the target range for the federal funds rate to 3/4 to 1 percent”. When the country’s economic conditions strengthen, its currency strengthens.

Sterling jumped after outgoing Bank of England policymaker Kristen Forbes unexpectedly voted for a rise in interest rates at the bank’s March meeting.

According to Reuters the Fed stuck to a forecast of two more rate rises this year, and three next year, but the Financial Times and Bloomberg claimed the Fed was signally three increases this year.

Ironically, the immediate story after the meeting was that there was no indication from the Fed that rates would rise for the rest of this year faster than earlier signalled, despite stronger economic data.

Between February 16, 2017, and March 8, 2017, the US Dollar Index rose almost 1.6%. “But it does signal officials may be more attuned to underlying data, especially inflation, because more willing to move sooner rather than later”, Craig Bishop, lead strategist, U.S. Fixed Income Strategies Group at RBC Wealth Management. If the current path of monetary policy is truly data dependent, then what inspired today’s move that left the Fed unmoved just six weeks ago? Although we continue to see Emmanuel Macron defeating Marine Le Pen in the second round of polls, uncertainty will persist for the time being and we are still two months away from knowing who the victor will be. The Fed is seeing widespread optimism coming from business sentiment and consumer confidence indicators, and solid investor sentiment that is apparent from financial market performance (Dow 21,000).

The pan-European STOXX 600 index (.STOXX) rose 0.7 percent and touched its highest level since December 2015, helped by the Fed’s dovish tone and the Dutch election results. Yellen will probably still be on the Fed board, and she’ll do her best to obstruct rate cuts because such a move will discredit her policies.

Looking toward year-end, the likelihood of four (or more) hikes was 24.7% and is now 20.4%.

Separately, the Bureau of Labor Statistics reported on Wednesday that the Consumer Price Index increased 0.1 percent in February.

As widely expected, the US central bank delivered the third rate increase in nearly a decade.

Asked what they saw as the main near-term risk to the economic outlook, six each cited President Donald Trump’s evolving policies on trade and on taxes and spending as the main threat, while two pointed to the strength in the USA dollar.

FOMC statement, March 15, 2017.

Economists said there was no change in its stance from the December meeting with many key economic forecasts maintained. But market turmoil early in 2016 and mixed U.S. economic signals meant the Fed could not move to increase rates again until a full year later.