European stocks weighed down by euro as United States assesses Harvey

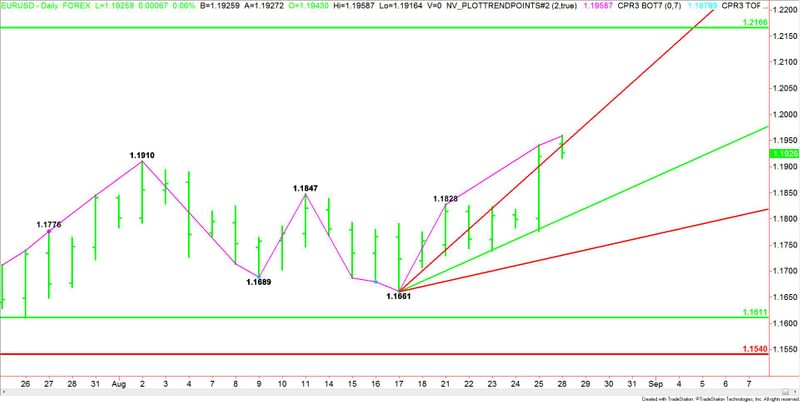

The dollar index, which measures the greenback against a basket of six major rivals, hit its lowest since May 2016.

Renewed euro strength pushed European stock markets to a two-week low, with German and French stock markets down around 0.3 per cent each.

Asian markets closed up: Tokyo’s Nikkei added 0.5 per cent, Hong Kong’s Hang Seng gained 1.2 per cent, and China’s Shanghai Composite jumped 1.8 per cent.

In Paris, Sanofi fell 0.33 percent after completing the acquisition of Protein Sciences, a vaccines biotechnology company based in CT, in the United States. In addition, North Korea launched a number of short-range missiles over the weekend. One currency strategist in Tokyo says that the European Central Bank is likely to intentionally taper its purchases of Euro area bonds, especially given that available bonds from Germany are running out while Italian bonds could test European Central Bank capital limits.

Republican President Donald Trump stoked anxieties by threatening on August 22 to shut down the government if Congress does not fund his U.S. -Mexico border wall. At 6:15 AM EST today, the US Dollar Index is trading at 92.45-a fall of 0.31%.

The yen tends to benefit during times of geopolitical or financial stress as Japan is the world’s biggest creditor nation and has a current account surplus.

So traders are thinking about the financial landscape with a man whose vision on monetary policy is actually little known to market participants.

The weakness is coming from several different source at the start of the trading week, including Hurricane Harvey, a lack of important USA economic data and comments made by Mario Draghi at the meeting of central bankers at the end of the prior week.

“Furthermore, investor positioning is extended in the euro versus the United States dollar and potentially at risk of being unwound”.

Gold futures for December delivery settled at $1,297.90/oz. on Friday after only briefly surpassing the $1,300/oz. mark during the day after the Dallas Fed President said the central bank should start decreasing its balance sheet “soon”.

ABN AMRO commodities analyst Georgette Boelle said gold could test the psychologically important level of $1,300 this week if USA data is supportive.

Investors also rushed to the safety of U.S. Treasuries, pushing down the 10-year yield to a low of 2.102 percent, its lowest since mid-November, while the yield on Germany’s 10-year government bond fell 3 basis points to 0.34 percent, the lowest since June 28.

“I don´t think expectations were that high in the market that Draghi would talk down the euro at Jackson Hole”.

“But no one can rule out the risk of accidents”. With the Cyclone Harvey hitting Texas very hard, it is likely that a lot of refineries in that region are shut down and this is going to hit the demand for crude oil in the short term.