Fed to guide on rate hike path with fresh language, forecasts

Unless, of course, Yellen & Co. belie the hints its chair has been dropping and double-cross the markets. And yes, some investors will mourn the end of their love affair with zero rates, but that grief has already been “priced into” their decisions: every investor and businessman with whom I have spoken has already taken into account the zeroing out of zero rates in his decision making. Look at it this way: Rates need to go higher now, in case they need to be lowered later.

But two groups are cheering. With the probability of the Federal Reserve raising interest rates next week at 75%, pundits are weighing in across Wall Street with everything from doomsday scenarios to a strategic yawn.

In the minutes of the July FOMC meeting, most Fed policy-makers “thought that it might be best either to wind down reinvestments or to manage them in a manner that would smooth the decline in the balance sheet in a predictable way”.

If incorporated into the Fed’s statement, such a phrase could signal a go-slow approach on rate increases, at least in the first half of next year, since many economists now expect falling oil prices and a rising USA dollar to continue to keep inflation low in coming months. “Higher interest rates would actually allow for loans to be priced in a way that accommodated some degree of risk”.

As for retail sales, “anecdotal evidence from retailers suggests that Black Friday sales were somewhat disappointing this year compared to last year’s bonanza, particularly given the reportedly softer start to the month as consumers delayed purchases”, UniCredit writes.

Moreover, the hike in interest rates has come when the economy is good, and not in the bad condition like before. This may go a long way toward explaining why the USA economy’s performance was below most economists’ expectations this year. Their predictions see a larger jump in short-term rates, with LIBOR increasing from around 0.35% to 1.45%, the Prime Rate from 3.25% to 4.25%, and the Fed Funds rate jumping from 0.25% to 1.25%.

The neutral, or equilibrium, rate changes through time, and Fed officials in September estimated that in the long run it will settle at around 3.5 percent, or 1.5 percent in real terms subtracting for 2 percent inflation, which is the Fed’s goal. “This is contributing to the Fed’s desire to move at a very slow pace”.

But the market seems a lot less sure that any rate hikes will follow quickly.

Reading between the lines in both Mr. Fischer’s and Ms. Yellen’s most recent speeches, as well as in European Central Bank president Mario Draghi’s underwhelming policy response to Europe’s woes last week, we can gather that central banks are most likely co-ordinating their efforts to stabilize the USA dollar.

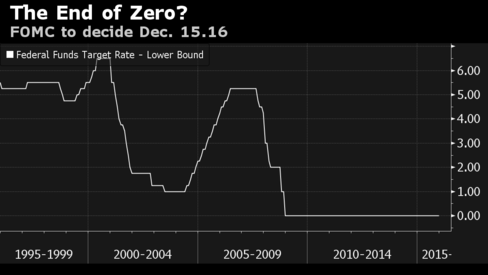

The Federal Reserve cut key interest rates to near zero in December 2008, at the peak of global economic crunch, to provide a boost to American economy. At this point, United States policymakers may be forced to tighten policy more swiftly than they had planned, risking putting the brakes on the global economy in turn.

Stock market investors are ready, but they may not be fully prepared for all of the nuanced remarks likely to accompany that announcement. But a normal pace would be about 20,000. The former appears to be more likely.

The heightened possibility of a USA rate hike and worries over the low crude oil prices weighed on investor sentiment. For example, if you have credit card debt on a card with a variable rate, that could affect your plan to pay it down or get out of debt generally.