Fed worries about China slowdown, strong dollar: minutes

The index pared losses, however, and was last down 0.21 percent at 95.294, or roughly unchanged from its level prior to the release of the minutes. The Nasdaq (.IXIC) declined 0.46%, or 22.01 points, to 4,769.15.

Fed minutes: A correction in the stock market and concerns about China were critical in the Federal Reserve’s decision to keep interest rates near zero, minutes from the last meeting released Thursday show. The USD/CHF was trading at 0.9665 Swiss Francs, down 0.73%.

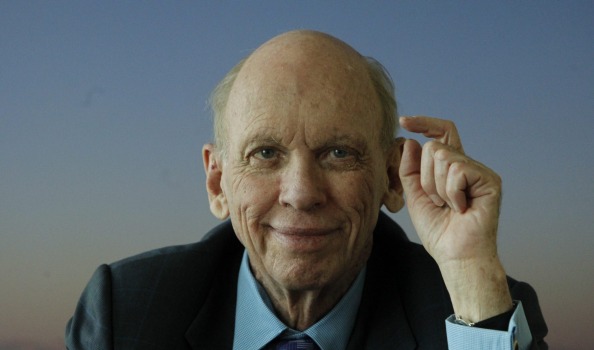

“They rehashed that people are waiting for clarity on the outlook of the economy”, said Stephen Carl, principal and head equity trader at Williams Capital Group LP.

The Fed decided at that meeting against hiking rates. But continuing to reinvest securities until rates were well above zero could help if there was an unexpected adverse shock.

Revised employment data from August and September showed that private sector hiring was lower than anticipated. The Dow also ended above its 50-day on Wednesday.

Crude resumed their rise after a United States government report showing a large inventory build briefly halted its rally.

Earnings season will unofficially start Thursday when Alcoa, the giant maker of aluminum and other metals, will report its results.

“There’s a lot of uncertainty among professional investors as to whether companies are going to make or miss” earnings targets, said Brett Mock, managing director at brokerage firm JonesTrading.

Netflix Inc.(NFLX) shares jumped 6% after the company raised the price of its most popular streaming plan in the U.S.by $1 for new customers as it ramps up investment in original shows and movies. Broader S&P 500 futures lost 0.6 percent to 1,975.70.

The blue-chips index were 23 points, or 0.1%, higher at 16,935, with DuPont (DD) leading gainers, up about 2%. The iShares Nasdaq Biotechnology ETF (IBB) closed down 0.2 percent after falling more than 3 percent.

Instead of acknowledging the pressure for a rate hike, Kocherlakota insisted that the central bank’s policy-setting Federal Open Market Committee (FOMC) consider a move in the opposite direction and approach negative-rate levels. The 10-year yield hit a one-week high of 2.086 percent overnight.

The aluminum producer is expected to post a year-over-year profit decline for the first time in six quarters (http://www.marketwatch.com/story/what-to-watch-for-in-alcoas-earnings-2015-10-05). The currency got a few support after the Reserve Bank of Australia left rates steady earlier this week and struck a less dovish tone than a few had expected. Its quarterly sales fell 10.7 percent and missed expectations.

The Nikkei-225 index at the Tokyo Stock Exchange fell 181.81 points to 18,141.17.

With the September payrolls report coming in soft, and Chinese markets reopening weak overnight after a holiday closure, there is simply less and less justification to raising rates for the first time since 2006 before the end of the year.

The euro rose to $1.1285 while the dollar was little changed at 119.92 yen.