Federal Reserve expected to hike rates amid nagging worries

The anticipated economic shift has been described as “momentous” and a hugely significant milestone of progress in the repairing of the U.S. economy since the damage done by the Great Recession.

The number of involuntary part-time workers went up in November, youth unemployment is above 15 percent and there are many discouraged workers who have stopped looking for work altogether. Many now working on Wall Street were not even around for the last so-called “hiking cycle”. Figure 1 employs four macroeconomic models used by Federal Reserve staff to estimate the “natural” real rate of interest, a concept closely related to the neutral rate.

Ending the low-interest-rate stimulus may seem like a bad idea after considering how it stokes the economic fire.

It has been a long wait for those in the industry who are veterans of a previous rise.

The most common inflation measure we hear reported in the media is the government’s Consumer Price Index (CPI). A string of positive surprises in the latter half of this year appear to have made an exit possible.

The Fed has previously established two conditions for raising rates, “further improvement” in labor markets, and “reasonable confidence” that inflation is moving higher toward the Fed’s 2% target.

Yellen noted that the transfer of funds would mean the Treasury has less revenue from the Fed in coming years on the interest earned on the securities that make up the $29 billion surplus account, an account meant to absorb losses. But, if you think about it, you need three things to have a house: ability to pay a mortgage, a down payment, and a FICO credit score.

For starters, Chair Janet Yellen and her band of banking buddies certainly missed other, more ideal times to begin raising rates earlier this year, when the markets were far more liquid and not up against the holidays and year’s end.

When the Fed does finally pull the trigger on its first rate rise since the crisis, there are fears over just what the effects will be. In plain English, that means more hiring and less firing.

The largest change since the crisis has been the growth of vast amounts of excess reserves the amount of cash sloshing around banks which has ballooned from a measly $2bn before the crisis, to some $2.6 trillion today.

Bank officials were quoted by Bloomberg as having said that oil’s price drop increases “the likelihood that headline inflation rates” will stay under wraps. Richard Convy, president at AAFMAA Wealth Management & Trust in Reston, Virginia, which operates under the American Armed Forces Mutual Aid Association, says bond substitutes such as REITs and master limited partnerships tend to underperform during periods of rising interest rates. Simon Potter, of the Federal Reserve Bank of NY, is running the operation, and has overseen its design.

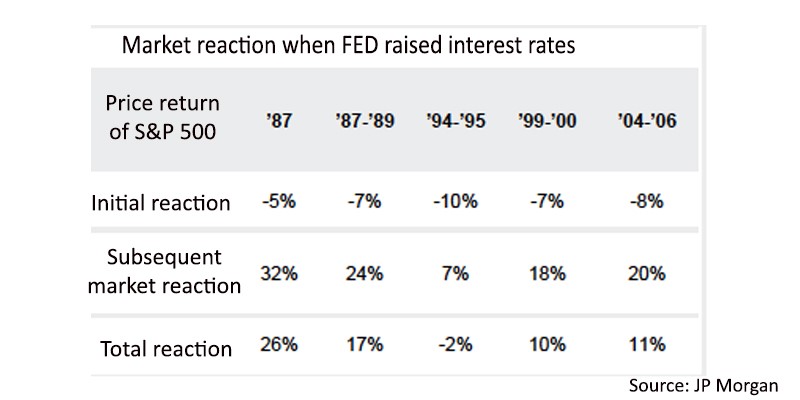

“They’re all smart people and well intentioned, but I don’t know that there has been enough investigation into the nonlinear response of the market to interest rates”. Stock prices generally decrease when interest rates go up, but that’s not always the case. Especially in emerging markets, where currencies and other assets have plunged in value this year, that process has already started.

What might be more challenging still is convincing investors that the path of increases after the first increase will be “gradual”. As the year progresses, the Fed, the market, and individuals will have a front row seat to see how stocks, mortgage rates, and the economy react. Likewise, the probability of a hike to 0.75% in April fell to 37%, from 35%, according to data on the Fed Funds futures market compiled by the CME.