Fossil Group Sees Strong Trading Volume on Earnings Beat (FOSL)

In response to the poor news, Fossil Group shares fell sharply, with the stock losing nearly 6% of its value in the first half-hour of after-market trading following the announcement. The intraday up/down ratio came in at 0.25. The net money flow for the block transaction was $(-2.26) million.

Fossil Group (NASDAQ:FOSL) opened at 64.40 on Friday. Institutional Investors own 85% of Company shares. Geographically, Fossil did well in the Americas, with sales rising about 1.4%, but a double-digit percentage decline in European revenue and a sizable drop in business from its Asian segment combined to pull down the company’s overall sales. Investors looking further ahead, will note that the Price to next year’s EPS is 10.54. Company shares. In the past six months, there is a change of 0% in the total insider ownership. On average, analysts anticipate that Fossil Group will post $5.58 earnings per share for the current fiscal year. The firm’s 50-day moving average is $69.18 and its 200 day moving average is $80.09. S&P 500 has rallied 7.26% during the last 52-weeks. The shares have received a hold rating based on the suggestion from 4 analysts in latest recommendations. Strong buy was given by 2 Wall Street Analysts. Underperform rating was given by 4 analyst. The primary factors that have impacted our rating are mixed, some indicating strength, some showing weaknesses, with little evidence to justify the expectation of either a positive or negative performance for this stock relative to most other stocks. KeyBanc maintains its view on Fossil Group, Inc. The shares have now been rated Underweight by the stock experts at the ratings house. Finally, Jefferies Group set a $115.00 goal price on Fossil Group and gave the organization a buy rating in a research report on Wednesday, May 6th. The rating by the firm was issued on July 1, 2015. The shares closed down 0.03 points or 0.05% at $64.27 with 1,366,507 shares getting traded. The company has a market cap of $3,137 million and the number of outstanding shares have been calculated to be 48,810,000 shares. Of all companies tracked, Fossil Group had the 16th highest net in-flow for the day.

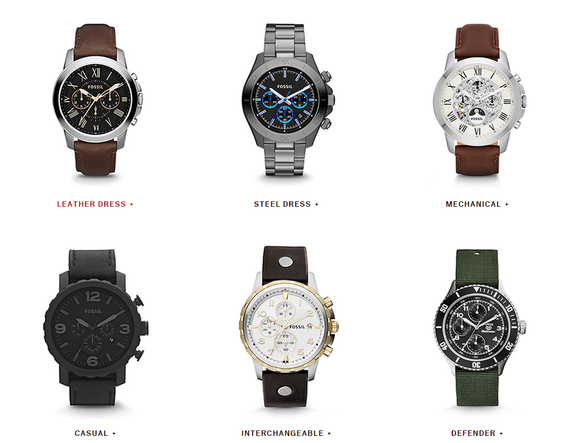

Fossil Group, Inc.is a global designer, marketer and distributor business that specializes in consumer fashion accessories. The Companys offerings include a line of mens and womens fashion watches and jewelry, handbags, small leather goods, belts, sunglasses, soft accessories and clothing. The Organization sells its products via a diversified distribution network which includes department stores, specialty retail locations, jewelry stores and specialty watch, Company-owned factory and retail outlet stores, mass market shops, and through its Website that is FOSSIL.