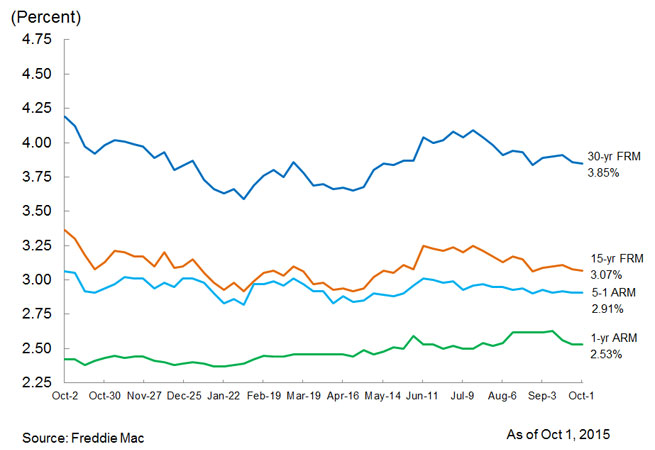

Freddie Mac: Mortgage rates below 4% ten weeks straight

“If you’re only looking at the interest rate spread, then it probably makes sense to take a five-year fixed if you think there is any likelihood of the Bank of Canada increasing rates any time soon”, said Jason Scott, an Edmonton mortgage broker with TMG The Mortgage Group. The two events expected to rock the mortgage market never came to fruition.

The 30-year fixed-rate mortgage averaged 3.85% for the week ending October 1, down from last week when it averaged 3.86%.

“This marks the tenth consecutive week of a sub-4-percent mortgage rate”, said Sean Becketti, chief economist with Freddie Mac.

WHAT I SEE: From rate sheets hitting my desk that are not part of Freddie Mac’s survey: Locally, well qualified borrowers can get a 15-year fixed at 3.0 percent and zero cost and a 30-year fixed at 3.75 percent and zero cost. It was 3.08 percent a week ago and 3.36 percent a year ago.

“Variable-rate clients who touched base in the spring and vacillated are now calling back with instructions”, said Sojonky, an adviser with Verico Paragon Mortgage Group in West Vancouver, B.C.

The average rate for a five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) was 2.91%, unchanged from the previous week. It was 3.06 percent a year ago. Similarly, the 1-year ARM retained its average rate from last week, as it’s still stands at 2.53%.

Mortgage rates were minimally lower this week, and the outlook is for little change over the next week – though a key economic report could change that.

Bankrate’s national weekly mortgage survey is conducted each Wednesday from data provided by the top 10 banks and thrifts in 10 top markets.