Freeport-McMoRan Inc 79% Potential Upside Now Implied by Gabelli & Co

Shares of Freeport-McMoRan (NYSE:FCX) opened at 11.27 on Thursday. The brokerage firm has set the Price Target of the shares at $20.25.

Freeport-McMoran, Inc. (NYSE:FCX), According to the latest information the short interest in Freeport-McMoRan Inc. shot up by 45.1% or 27,948,860 shares.

Freeport-McMoRan Inc NYSE:FCX has a 50 day moving average of 12.62 United States dollars and the 200 Day Moving Average price is recorded at 18.87 USD.

General Electric Company (GE) of the Industrial Goods sector is up 1.92% trading at a volume of 4222802 shares. After trading began at $10.82 the stock was seen hitting $11.34 as a peak level and $10.78 as the lowest level. Following the acquisition, the insider now owns 4,332,934 shares of the company’s stock, valued at $42,029,459.80. Apple Inc. (AAPL)’s weekly performance is – 3.55% and compared to their 52 week low, they are up 22.32% with a dividend yield of 1.90%. On a different note, The Company has disclosed insider buying and selling activities to the Securities Exchange, The Securities and Exchange Commission has divulged in a Form 4 filing that the director officer (Chairman of the Board) of Freeport-Mcmoran Inc, Moffett James R had purchased shares worth of $1,057,000 in a transaction dated on August 28, 2015. During the same quarter in the previous year, the firm earned $0.58 earnings per share. The 52-week low of the share price is $7.76. Finally, Zacks downgraded shares of Freeport-McMoRan from a “hold” rating to a “strong sell” rating in a research report on Thursday, August 20th. Now the company Insiders own 0.6% of Freeport-McMoRan Inc. Morgan Stanley restated a buy rating on shares of Freeport-McMoRan in a research report on Thursday, July 23rd. The stock was acquired at an average cost of $9.70 per share, for a total transaction of $21,340,000.00. Three investment analysts have rated the stock with a sell rating, twelve have assigned a hold rating and nine have given a buy rating to the company’s stock.

Freeport-McMoRan Inc. (NYSE:FCX) is a natural resource company with an industry portfolio of mineral assets, oil and natural gas resources, and a generation profile.

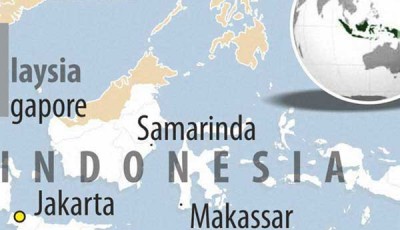

On September. 3, Standard and Poor’s lowered its outlook on the company to negative from stable, a move that indicates the BBB- rating may be cut, citing the possibility that cost-cutting and production targets won’t be met. FCX has its operations into five primary divisions: North America copper mines, South America mining, Indonesia mining, Africa mining and Molybdenum operations. The Company is also engaged in operating copper conversion facilities located in North America, and a refinery, three rod mills and a specialty copper products facility. The Business’s Atlantic Copper smelts and refines copper concentrates and markets refined copper and precious metals in slimes.