Global Economic Uncertainty Drives Down Mortgage Rates

The data, outlined in Freddie Mac’s Primary Mortgage Market Survey, indicated that The 30 year averaged 4.15 percent in the same week a year ago. The lower rates brought an incentive for prospective purchasers toward the end of the spring home buying season. Homeowner affordability has been strained, especially among first-time homebuyers.

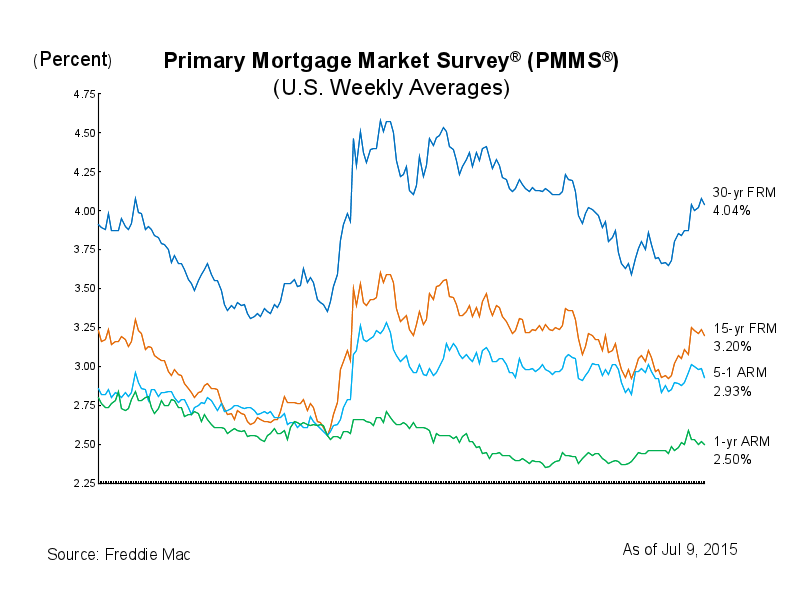

30-year fixed-rate mortgage (FRM) averaged 4.04 percent, with an average 0.6 point for the week ending July 9, 2015, down from last week when it averaged 4.08 percent.

Mortgage rates pulled back this week, with the benchmark 30-year fixed mortgage rate sliding to 4.14 percent, reported by Bankrate.com’s national survey.

The average rate for a five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) was 2.93%, down from 2.99%.

For the second week in a row, and just the third time on record, the average rate for the jumbo 30-year fixed rate mortgage is below that of the conforming 30-year fixed mortgage. “Mortgage rates fell as well, although not by as much as government bond yields”.

For loan amounts from $417,001 to $625,500, the rate for a 10-year, zero-cost ARM is 3.99 percent, compared to a 30-year fixed at no-cost at 4.25 percent.

“Overseas volatility is likely to persist for some time, providing a few restraint on potential US rate increases”, said Becketti.

15-year FRM this week averaged 3.20 percent, with an average 0.5 point, down from last week when it averaged 3.24 percent.

What’s up with mortgage rates?

Additionally, the 1-year Treasury-indexed ARM averaged 2.50%, down from 2.52% last week, but up from 2.40% a year ago.

The 15-year, fixed dipped to 3.28%, down from 3.34% last week, while the 5/1 ARM decreased to 3.16%, down from 3.25% a week ago.