Gold Up on Haven Demand, Platinum Pressured By Volkswagen Scandal

The platinum to palladium price ratio pushed towards its lowest point in thirteen years and with the investigation now spilling over to BMW the future of small engine diesel cars remains in doubt.

Gold firmed, following two days of losses, as the United States dollar fell as much as 0.2 per cent against a basket of leading currencies, while weak Chinese factory data soured investor appetite for risk.

Volkswagen’s shares have lost nearly a third of their value this week.

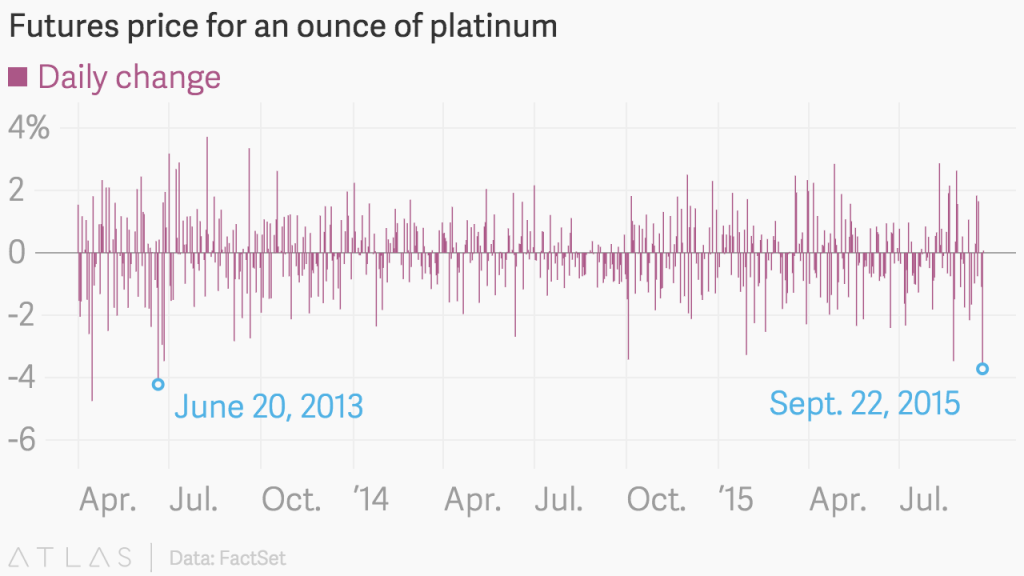

Volkswagen has admitted the charge and revealed that it has in fact installed the “defeat device” in 11 million diesel-powered vehicles across the world, unfolding a diabolical act in the automobile history. “At some point platinum and palladium prices will go to parity … my guess would be between $700 and $850”. It could eventually result in penalties of up to $18 billion, per the EPA. As recently as 2008, platinum was valued at $1,250 more than gold, a valuation that now exists only as a golden memory for platinum investors. Platinum is used in diesel catalysts to clean up exhaust emissions.

But collateral damage from news of the VW scandal rolls on daily. Diesel vehicles were already experiencing lower demand amid falling crude oil prices turning people away towards gasoline vehicles. Almost 70% of this total was shipped to Asia.

On Friday, the rally in the palladium price continued to build as the outlook for diesel vehicle sales becomes murkier following top automaker Volkswagen’s admission a week ago that it’s been cheating on pollution tests. The latest VW scandal has further added to its woes.

“I’m not sure that this is negative for platinum, if anything, they may have to replace some converters, which may lead to an increase in demand”, said Patrick Magilligan, the head of market research at A-1, a recycler of platinum-group metals based in Croydon, Pennsylvania.

“If Volkswagen were doing the same thing in Europe and if there is more to come, it would be really bearish for the platinum market”. Demand for platinum in catalysts rose by 4% past year, the fastest rate of growth since 2011. PALL has increased 1.3% over the past week and 0.7% in the past month, but the fund is still down 24.1% year-to-date.

Walt and Alex Breitinger are commodity futures brokers in Valparaiso. It is expensive with an expense ratio of 0.75% and trades in a small volume of 665 shares per day.

If regulators uncover widespread violations across the industry and environmentally-conscious drivers in Europe switch to gasoline, it could “reshape the picture” for platinum, said Erica Rannestad, senior analyst, precious metals demand at GFMS.

“It’s a lot easier for gasoline cars to comply to the new standards than diesel cars”, said Simona Gambarini, a precious metals analyst at Capital Economics.