Halliburton, Baker Hughes market more businesses to gain regulatory approval

Baker Hughes is selling its offshore hydraulic fracturing business in the Gulf of Mexico, along with two vessels that carry the necessary gear to frack the wells and control the sand spilling from the oil-soaked reservoir under the seabed.

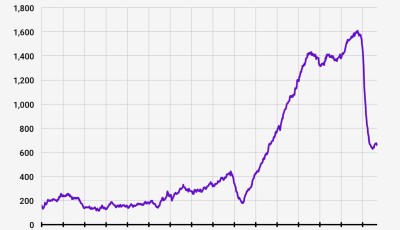

The companies face difficulties in gaining regulatory approval for their $34.6 billion merger.

Halliburton, North America’s top pressure pumper, said as of last Friday it has proposals from “multiple interested parties” for a package of assets that include its fixed cutter and roller cone drill bits, directional drilling and logging-while-drilling/measurement-while-drilling business units. “In light of the timing agreement, Halliburton and Baker Hughes have agreed to extend the time period for closing of the acquisition pursuant to the Merger Agreement to no later than December. 16, 2015″.

Halliburton said its making on progress on those divestitures.

The joint announcement provided the first details on asset sales Halliburton said in July it was proposing to global competition regulators. The analyst, who noted that Baker Hughes shares were trading at a 13% discount to the deal price at the time he wrote his note, thinks fears of a break-up are overdone and keeps a Neutral rating and $65 target on the stock and an Overweight rating and $51 target on Halliburton.

Presently, the audit will, at the soonest, close on the later of December 15 – from the present date of November. 25 – or 30 days after the date on which the two companies completely consent to the DOJ’s second demand. When the companies announced the deal, Halliburton said it foresaw up to $7.5 billion in assets may have to be sold to win approval, but that it did not expect regulators to demand such large divestitures. Total (Swiss: FP.SW – news) revenues from all the businesses planned for divestiture were $5.2 billion in 2013, the companies said.

Halliburton plans to sell a business that markets expandable liner hangers, which are devices that suspend lengths of pipe inside an oil well to seal it from leaks.

The businesses’ offer is dependent upon the merger being endorsed by controllers.