Harley-Davidson second-quarter earnings fall, beat expectations

Earlier, the shares had a rating of Outperform.

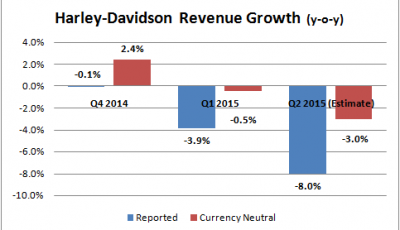

Harley-Davidson Inc. on Tuesday said its revenue and profit slid in the latest quarter, though earnings still came in better than Wall Street expectations. The rating by the firm was issued on July 8, 2015. (NYSE:HOG) is ranked 2.19 based on 10 broker recommendations. The company had revenue of $1.65 billion for the quarter, compared to the consensus estimate of $1.68 billion. (NYSE:HOG) is expected to report earnings per share for the current fiscal quarter of $1.39. The stock has a 50-day moving average of $55.79 and a 200-day moving average of $59.59. The most bullish firm sees the stock reaching $73 within the year while the most conservative has their price target set at $55.

The USA dollar rose approximately 10% against most foreign currencies in the first quarter alone, allowing Harley’s foreign manufacturers to cut their model prices, in some cases, by as much as $3,000 off the manufacturer’s suggested retail price. (NYSE:HOG) ended Monday session in red amid volatile trading. Now the company Insiders own 0.2% of Harley-Davidson, Inc. In the second quarter, there were about 208.6 million weighted-average diluted common shares outstanding, compared to roughly 219.2 million shares in the same quarter past year. The company has a market cap of $11.99 billion and a P/E ratio of 14.4873. (NYSE:HOG) have given the stock a one-year price target of $63.1.

Harley-Davidson, Inc. has lost 2.81% in the last five trading days and dropped 6.9% in the last 4 weeks. The stock is down 20% since the end of June last year, after rising 316% in the five-year period before that. Year-to-Date the stock performance stands at -15.77%.

Separately, TheStreet Ratings team rates HARLEY-DAVIDSON INC as a Buy with a ratings score of B. The total value of the transaction was worth $497,277.

Harley-Davidson, Inc.is the parent company for the groups of companies doing business as Harley-Davidson Motor Company (HDMC) and Harley-Davidson Financial Services (HDFS). The Company operates in two segments: the Motorcycles & Related Products (Motorcycles) segment and the Financial Services segment. The Company conducts business on a global basis, with sales in North America, Europe/Middle East/Africa (EMEA), Asia-Pacific and Latin America.