Harley-Davidson stock riding high despite lower profit

“In the face of a tough competitive environment, driven mostly by currency and greater competitive activity, we are leveraging our many strengths and meeting the challenge head on”, said Matt Levatich, president and chief executive of Harley-Davidson.

The dollar has strengthened over the past year, meaning that buying Harley has become more expensive for global buyers, while Americans can often get a better deal on foreign bikes because of the greenback’s relative strength.

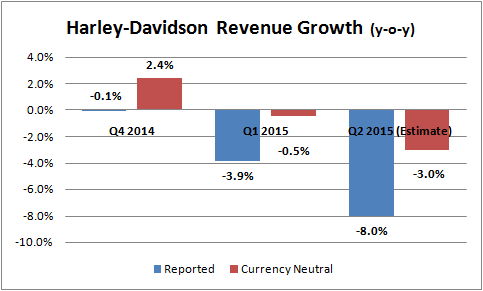

The Milwaukee, Wisconsin-based motorcycle manufacturer posted Q2 total revenue figures of $1.82 billion, down from $2 billion a year ago. Harley also said it will not lower prices on its iconic motorcycles and that a recent drop in its share price warrant ramping up a share buyback. “Our actions during the quarter have had a positive impact. We are encouraged by the momentum in retail as the quarter progressed, both in the USA and internationally”. Approximately 3,660,648 shares were traded during trading, an increase of 50% from the previous session’s volume of 2,445,486 shares.The stock last traded at $57.10 and had previously closed at $54.94. Rivals also increased the pressure on Harley Davidson’s profit margins by pushing discounts. Harley’s market share is down 4.7 percentage points from a year ago, to 51.3% in the US, mainly as its Japanese and European competitors took advantage of the strengthening US dollar, and manufacturing in low-priced countries, and subsequently adopted aggressive product pricing. The shares have now been rated Sector Perform by the stock experts at the ratings house. The 52-week high of Harley-Davidson, Inc. Harley-Davidson expects to ship 276,000 to 281,000 motorcycles worldwide, and that capital expenditures will be in the range of $240 million and $260 million. (NYSE:HOG) according to the research report released by the firm to its investors.

New motorcycle sales at dealers declined 1.4% globally during the quarter, although Harley Davidson said they did pick up momentum as the quarter went on. Canada remains among the only markets operating through a third-party distributor arrangement.

As with all financial results, fans of the reporting company will see the forest through the trees while others will claim doom and gloom.

Wall Street sell-side research firms who cover Harley-Davidson, Inc.