Has The Apple iPhone Reached Its Limits? (NASDAQ:AAPL)

Revenue in the category jumped from $2.7bn (£1.89bn) in the first quarter of 2015 to $4.35bn (£3.04bn) in the first quarter of 2016.

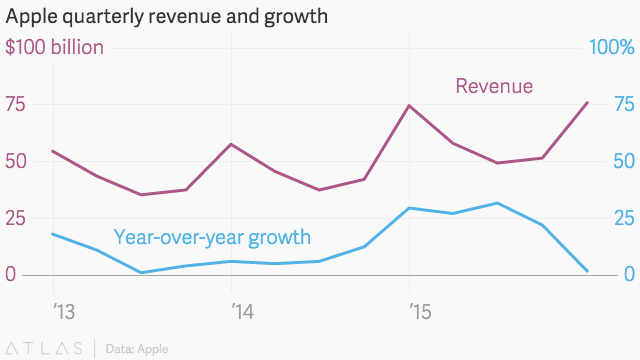

Apple forecasts that its total revenue in Q2 2016 will be between $50 and $53 billion, compared to $58 billion in the year-ago quarter, signaling the company’s first year-over-year drop in revenue in thirteen years.

Tim Cook, CEO of Apple, in a statement explained that Apple’s services business and its growth lead to the acceleration for the quarter which produced record results.

The company also announced there’s a billion Macs, iPhones, iPads, Apple Watches, and Apple TVs actively being used at this moment.

Apple posted record quarterly revenue of $75.9 billion, compared to $74.6 billion in sales during the same period in 2014. It was also the first big quarter for the iPhone 6s and 6s Plus, which saw very little growth from previous year.

Apple, which is the world’s most valuable company by market share and sales, has not reported a fall in iPhone sales before but it’s understood that investors have feared a slowdown after the huge success of the last decade.

Investors took out their ire on Apple early Wednesday, driving Apple shares down by nearly 5 percent at one point, to $95.27 following the company’s fiscal first-quarter results. Such offerings brought in $5.5 billion in Apple’s most recent quarter, up 15 percent year-over-year.

The iPhone did at least manage some nominal growth, but other Apple products fared less well.

iPhone sales peak each year in the holiday season, and they were flat in the last quarter of 2015 relative to the same period a year prior.

The change in the sales of iPhone, iPad and Mac lineup didn’t result any major adverse affect on the quarterly earnings.

Apple sold 74,8-million iPhones during the last quarter, which is less than 1% more than the number of iPhones it sold a year ago. This marks little change from Apple’s Q1 2015, when the company reported $18 billion in profit and $74.6 billion in revenue.

In constant currency, this prediction would indicate a 5%-10% drop in revenue, explained Apple CFO Luca Maestri.