Hillary Clinton offers plan to help students with children

She’s come up with a plan to tackle student debt called the College Compact plan.

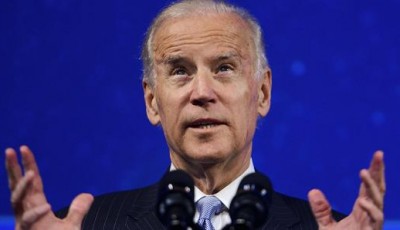

Clinton wrapped up her remarks at the town hall meeting by contrasting herself with her Republican counterparts, with a line that is now becoming familiar on the campaign trail.

Candidate Clinton also joins others in calling for schools to be held financially accountable for graduating too few students of the students they decide to enroll, and for failing to properly equip those who do manage to complete their studies with the tools they need to secure employment that pays enough to cover the bills. The plan aims to increase the availability of low-interest grants and loans and ensure the federal government “will never again profit off student loans for college students”.

Each challenge reflects the difficulty of transforming a higher-education system increasingly dependent on personal debt.

What’s more, by making these student-specific tuition payments, the government would then be in a position to directly assess individual outcomes to help in determining the precise amount to charge back to the schools for their academic failures.

Bernie Sanders, Clinton’s opponent for the Democratic nomination has proposed a alternative plan of $70 billion per year, financed by taxing transactions made by hedge funds and investment houses as well as other Wall Street firms, which seem equally unlikely to pass, as it would face the same opposition by the ultra rich as Hillary’s.

Brad Streicher, another student from the University of Southern California, thinks Clinton has good intentions about decreasing student loan debt, but may be going about it the wrong way.

The bill would create a Wisconsin Student Loan Refinancing Authority, modeled after the Wisconsin Housing and Economic Development Authority. The concern is that pouring 0 billion on that fire could have seriously undesirable consequences. There is a $3.4 million gap in lifetime earnings between the highest- and lowest-paying college majors, which is three times larger than the gap in lifetime wage of college and high school graduates, according to a 2015 report by the Georgetown University Center on Education and the Workforce. Most students who take part-time course loads do so because of financial realities that make full-time class schedules impossible.

Student loan debt remains a big problem for this country. The details are outlined by the Department of Education, and you should speak to your loan servicer. The average balance owed is $29,000.

These solutions can help a number of people.

Her praise for the proposal is not the actress’s first foray into politics.