Hong Kong stocks fall for 7th day

We are not expecting conditions to worsen in China.

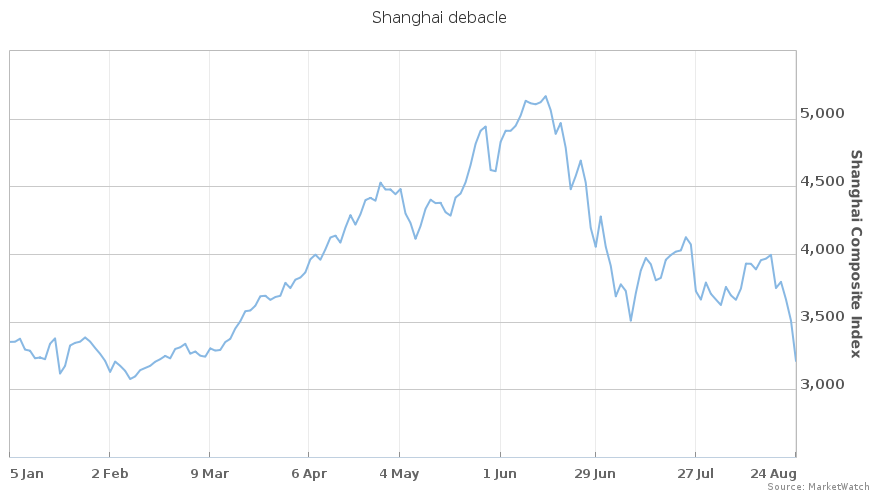

Chinese stocks crashed on Monday, with the benchmark Shanghai Composite Index down 8.45 percent to close at 3,211.2 points.

“One more down-leg like that and the state will have to buy another swathe of shares to try to push the index away from the “key” 3,500 level“. The decline in the Shanghai Composite brought the running tally to approximately -37% down from the mid-June highs.

To be sure, Asia΄s bond markets have proved somewhat resilient compared with currencies and stocks in the region, which have been hardest hit by jitters over China and expectations the U.S. will soon raise short-term interest rates. The fund will be able to invest up to 30% of its assets, now ~$548 Billion (3.5 Trillion Yuan). The euro was regular at $1.1379 after touching a two-month excessive of $1.1395.

“There is a lot of politics in the Chinese stock market, as well as a lot of things going on behind the scenes, but as long as economic growth keeps slowing, and the overall real economy continues to weaken, we are unlikely to see a bull market in shares“, he added.

Brace yourselves, investors: Things are looking even uglier today than on Friday, the Wall Street Journal and others report.

The bigger question at this point is whether the Chinese meltdown, and further the contagion of this meltdown can be countered with a single economy’s monetary policy. “The government won’t step in to rescue the market again as it’s a global sell-off and it’s spreading everywhere now”.

“In general, Asia credits have outperformed equity and the selloff for bonds is modest so far”, said Ben Sy, head of fixed income in Asia at J.P. Morgan Private Bank in Hong Kong.

However, the move offers very limited help for the market in the near term. The Fed has kept the rate at zero since December 2008. As the Euro became a viable funding currency with negative rates and a wide-ranging QE program, it became a favorite of traders looking to try to trap the carry. But that and a weaker reading of a purchasing managers’ index survey in the United States were “not bad enough to change our fundamental outlook for global growth”, he said.

“We have seen some strength in gold, but investors have not been turning to it in the way they used to”.

Over the weekend markets had a tremendous fall, not just on the U.S. front but practically all markets are suffering.

Meanwhile, in China’s pilot reform zones, such as in the wealthy coastal city of Wenzhou in Zhejiang province, qualified financial institutions from Hong Kong and Macau are also allowed to set up fully licensed brokerages and hold up to a 49% stake.

Moreover, the Chinese government’s multiple interventions over the past month to prop up its stock markets have likely had the opposite effect.