How Insiders and Institutions are Trading Advanced Micro Devices, Inc. (AMD)

A statistical measure of the dispersion of returns (volatility) for AMD producing salvation in Investors mouth, it has week volatility of 2.59% and for the month booked as 3.48%. This is a bearish signal that suggests the stock price might have farther to fall. The firm’s market cap is $13.14 billion. Today’s three big stock charts will review the trends and indicators behind these forecasts. $1.98M worth of stock was sold by Su Lisa T on Tuesday, June 13. Finally, Deutsche Bank AG restated a “hold” rating and set a $12.00 target price on shares of Advanced Micro Devices in a report on Thursday, September 21st. Shaker Financial Services Llc owns 39,937 shares or 0.25% of their United States portfolio. When companies gear up to release the next round of quarterly earnings results, investors will be closely watching to see how profitable the overall quarter was. Investors measure stock performance on the basis of a company’s earnings power. Looking at volatility levels, the stock observed volatility of 3.02% in last week and saw volatility 3.58% over the past one month. Baillie Gifford & Co. bought a new position in shares of Advanced Micro Devices during the 2nd quarter valued at about $184,767,000. Over the past month, the stock has performed 2.29%.

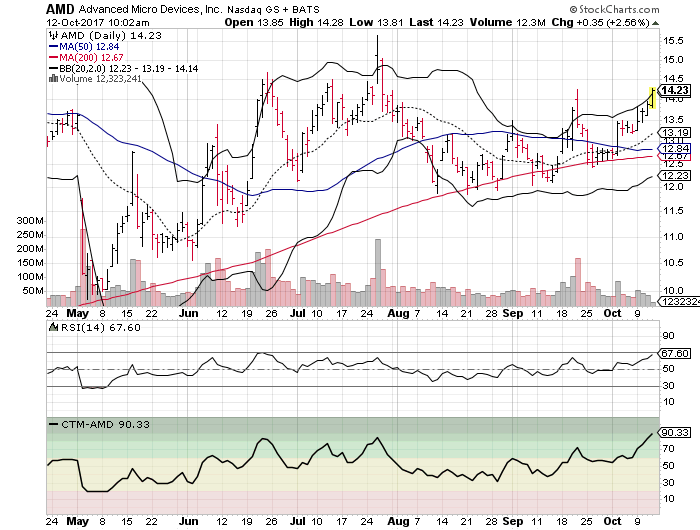

Before trading, trader, investor or shareholder must have an eye on stock’s historical performance. (AMD) to generate earnings per share of $0.01 in 2017. CCI is relatively high when prices are much higher than average, and relatively low when prices are much lower than the average. Wells Fargo & Company reiterated an “outperform” rating and issued a $15.00 target price on shares of Advanced Micro Devices in a report on Wednesday, June 21st. The consensus recommendation for stock is 2.70. This is based on a 1-5 scale where 1 indicates a Strong Buy and 5 a Strong Sell. “Ultimately, through all this investigation into the company’s performance the analyst decides whether their stock is a “buy”, sell” or hold”. Moving averages can be used to help filter out the day to day noise created by other factors. Zooming out to the 50-day, we can see that shares are now trading 2.65% off of that mark. The stock stands 11.64% away from its 50-day simple moving average and 13.06% away from the 200-day average. Moving average strategies are also popular and can be tailored to any time frame, suiting both long term investors and short-term traders. Moving averages can be very helpful for identifying peaks and troughs. They may also be used to help the trader figure out reliable support and resistance levels for the stock. Analysts have a mean recommendation of 2.10 on this stock (A rating of less than 2 means buy, “hold” within the 3 range, “sell” within the 4 range, and “strong sell” within the 5 range). (NASDAQ:AMD), we can see that the stock has a current beta of 2.52. The price now stands at $14.33. Vanguard Group Inc. increased its position in shares of Advanced Micro Devices by 6.6% during the 2nd quarter.

Moving average indicators are used widely for stock analysis. In current trading day Aspen Technology, Inc. AMD’s average trading volatility during the past few weeks is -16.66% lower than the average volatility over the past 100 days. For the past 5 years, the company’s revenue has grown 0.8%, while the company’s earnings per share has grown 13.3%. Let’s take a look at some of the numbers for Advanced Micro Devices, Inc. Insider ownership during the previous year has decreased by a net of 91.74 million shares. (NASDAQ:PLCE) is worth US$1.86 Billion and has recently fallen -1.49% to US$105.55. WOLIN HARRY A sold $597,656 worth of Advanced Micro Devices, Inc.

Advanced Micro Devices, Inc. has a 52 week low of $6.22 and a 52 week high of $15.65. Taking a broader view, the current separation from the 52-week high is -8.56%, and the distance from the 52-week low is now 130.06%. AMD is now priced at a -0.49% to its one-year price target of 14.27. On average, equities analysts expect that Advanced Micro Devices, Inc. will post $0.10 EPS for the current fiscal year.