IBM beats earnings but investors yawn

It is not all doom and gloom for the company if you consider that the server division is expected to report growth, as it has had an encouraging quarter due to the increased demand for enterprise server.

IBM gets more than half its revenue from overseas.

Earnings adjusted for one-time gains and costs were $4.84 per share.

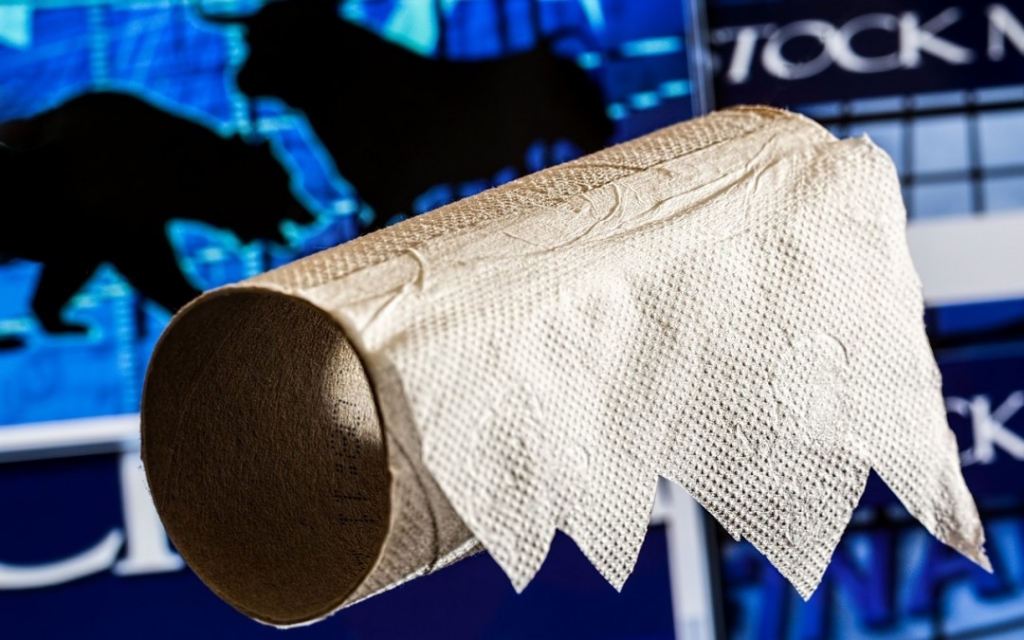

Fourth quarter revenue declined for the 15th quarter straight to $22.1 billion, which met the average analyst expectation.

Overall, IBM posted earnings of $4.46 billion, or $4.59 a share, compared with $5.48 billion, or $5.51 a share, a year earlier.

Enterprise IT vendor IBM’s revenue is on a free fall. IBM is still miles away from completing its transition to the cloud but the company is headed in the right direction and its stock should improve over the next fiscal year. During the third quarter, nine percentage points of IBM’s revenue decline was attributed to currency, and another four percentage points was attributed to divested businesses. The cloud computing, data analytics, security and mobile computing products on which IBM has bet its future grew at a strong pace.

“We’re transforming a big company”, Mr. Schroeter said in an interview on Tuesday. Strategic imperatives now comprise 35% of total revenue.

IBM has reported declining year-over-year revenue for the last 14 consecutive quarters. International Business Machines Corp. comprises about 1.0% of Benjamin F. Edwards & Company’s investment portfolio, making the stock its 20th largest position. (NYSE:IBM) issued an update on its FY16 earnings guidance on Tuesday morning.

The market was not overly impressed with the results, despite IBM’s attempt to put a positive spin on the situation, and the firm’s share price fell in after-hours trading on the New York Stock Exchange. Systems hardware revenue fell 1.4% to $2.37 billion, while global business services revenue decreased 9.9% to $4.3 billion. Its Global Business Services segment offers consulting and systems integration services for strategy and transformation, application innovation services, enterprise applications, and smarter analytics; and application management, maintenance, and support services.

When one analyst asked when investors could expect to see some growth, IBM defended its moves.