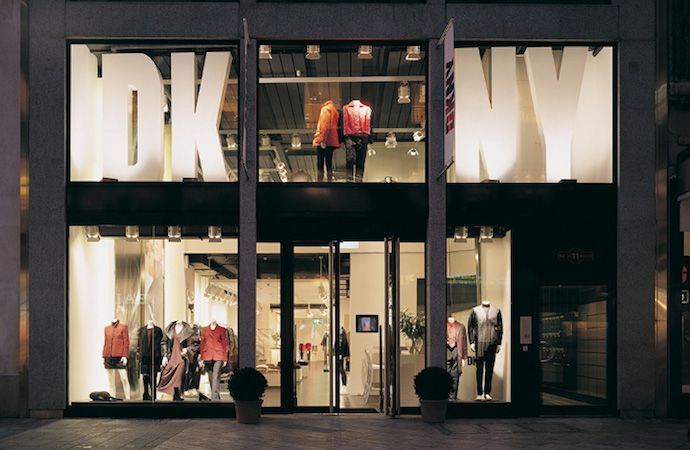

III snaps up Donna Karan from LVMH for $650m

The rumors are true!

The New York Times noted Monday that the sale is just the second in LVMH’s almost 30-year history, having sold Christian Lacroix in 2005.

It is only the second time LVMH, which also owns Christian Dior and Luis Vuitton, has sold a fashion brand in its 30-year history.

LVMH Moë t Hennessy Louis Vuitton SE agreed to sell Donna Karan International Inc.to apparel company G-III Apparel Group Ltd. for $650 million including debt, an unusual retreat for the French luxury giant. G-III has fashion licenses under the Calvin Klein, Tommy Hilfiger, Karl Lagerfeld, Kenneth Cole, Cole Haan, Guess?, Jones New York, Jessica Simpson, Vince Camuto, Ivanka Trump, Ellen Tracy, Kensie, Levi’s and Dockers brands.

This is only the second time LVMH has offloaded one of its prized lines, after it sold Christian Lacroix to the United States duty-free chain Falic Group in 2005. That number is only $7 million more than what LVMH paid for the brand back in 2001.

“We believe the DKNY brand has a dynamic position in the market, and when G-III approached us about acquiring the brand, we concluded that the time was right and that G-III was the right steward going forward”.

He also said that they were not thinking about selling Donna Karan though it was loss making for them. The deal had an enterprise value of $650 million. That’s why they chose to sell Donna Karan to G-III.

The French firm has agreed to sell Donna Karan International to United States design and licensing specialist G-III Apparel, which makes clothes for brand names including Calvin Klein and Tommy Hilfiger under a licensing agreement.

In fashion industry trend is very important and competition is very tough.

“We both grew up in NY and DKNY has always been part of the landscape of this city in our formative years as designers and New Yorkers”.

After this team was formed they analyzed the low performing units of LMVH.

It remains unclear in which direction G-III will take both brands and if they will continue with its existing retail and wholesale portfolio.

Analyst Luca Solca shared his views about this huge business deal saying.