India’s central bank leaves interest rates unchanged

“We hope RBI announces rate cut of at least 25 basis points in its next policy meeting, would somewhat help the sector in clearing its unsold inventory”, said Samir Jasuja, CEO and founder at PropEquity, a real estate data, analytics and research firm.

Besides, production momentum is weak, auto sales are low, and a secular upward trend in credit growth remains elusive.

With wholesale price inflation continuing to tread in the negative zone for the eighth consecutive month, and calls for rate cuts thereof getting shriller, Rajan said the RBI prefers to formulate its policies based on CPI which gives a better picture of the pinch at the individual level. Even the federal government needs the benchmark price to be cut to prop up progress.

Households expect inflation to touch 10.1 per cent within three months, according to the RBI survey conducted in June, higher than 9 per cent in the previous survey in March. The fact that the risks to RBI’s inflation projections are now seen as “balanced” around the 6% target for January 2016 as opposed to “upside” risks in the last policy suggests the room for a rate cut has been left open for later in the year.

During the calender yr, RBI has lowered the speed thrice by 0.seventy five %.

Accordingly, the repo rate at which the RBI lends to the system, will continue to be unchanged at 7.25 per cent and the cash reserve ratio, which is the proportion of deposits banks have to park with the central bank, will remain 4 per cent.

Said RBI governor Raghuram Rajan “global economic activity has recovered, projected output growth for FY16 is 7.6 percent“. Three successive rate cuts have not had much impact on bond yields because of lack of demand with FIIs nearing their buying capacity limit.

“The decision of the central bank to keep the policy rate unchanged is disappointing for the industry”, said Jyotsna Suri, president of the Federation of Indian Chambers of Commerce and Industry (FICCI).

“We are looking for whether the recent increase in inflation is temporary and whether the monsoon will continue to be near normal”, said Raghuram Rajan, Governor, RBI, while addressing a press conference here to announce the third bi-monthly monetary policy.

While the BoE typically ignores factors with a brief impact on inflation such as swings in oil and food prices, big currency moves are on the borderline between a short-term and a long-term factor.

The second interesting point in Rajan’s statement is that the government and banking regulator are on the same page, as far as veto power of the Central Bank chief is concerned. Headline inflation held steady at just over 5.5 per cent in June 2015, while core inflation slowed marginally to just below 2 percent.

“Given the awaken sentiments in the market, but, RBI could have further pulled the wave by easing key rates a bit”, Mr. Gaur said.

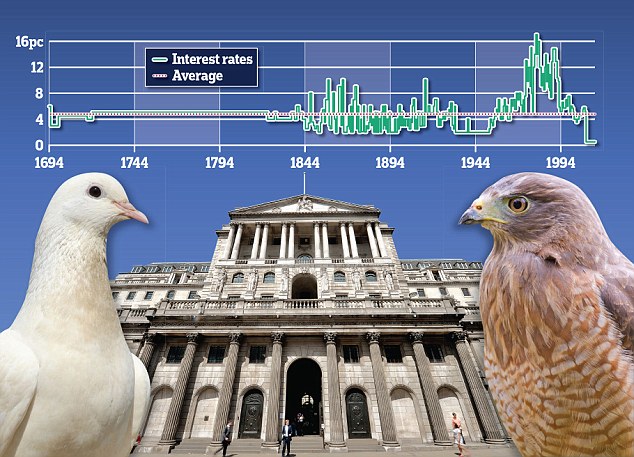

The Repo rate increased by 150 basis points since September 2014, but this is still below its longer term average.

While the bank has been trying to effectively manage inflation, it has also been at loggerheads with the government regarding the formation of monetary policy committee (MPC).