Inflation Slows Further In July CPI

The Consumer Price Index (CPI) for All Urban Consumers (CPI-U) rose by just 0.1%, indicating weaker-than-expected inflation pressure in July. Declines in hotel rates, vehicle prices and child care accompanied a continuing drop in wireless-phone service costs that some Fed officials have labeled as transitory.

Unemployment has fallen to a 16-year low of 4.3 percent, yet wages have risen only at a disappointing 2-to-2.5-percent rate annually, which in turn reflects weak overall inflation. If inflation does start to pick up faster then there could be another hike on the cards before the end of the year.

Odds in financial markets for a December rate increase stood at 30 percent after the data, unchanged from before the report.

The US central bank has a 2% inflation target and tracks a measure that has been stuck at 1.5% since May.

With the consumer price index coming in low, “we have the luxury of waiting to see what actually happens”.

An exception is medical care commodities, which were up 1.0 percent in July and are now up by 3.7 percent over the previous year. Core prices, which exclude food and energy to better capture inflation’s trend, were also up 0.1% on the month and 1.7% on the year.

Economists have said the Fed will need to see inflation pick up in the next several months, and the July reading will be dismissed.

The soft inflation data will embolden Fed doves, who have been urging for a pause, said Ian Shepherdson, chief economist at Pantheon Macroeconomics.

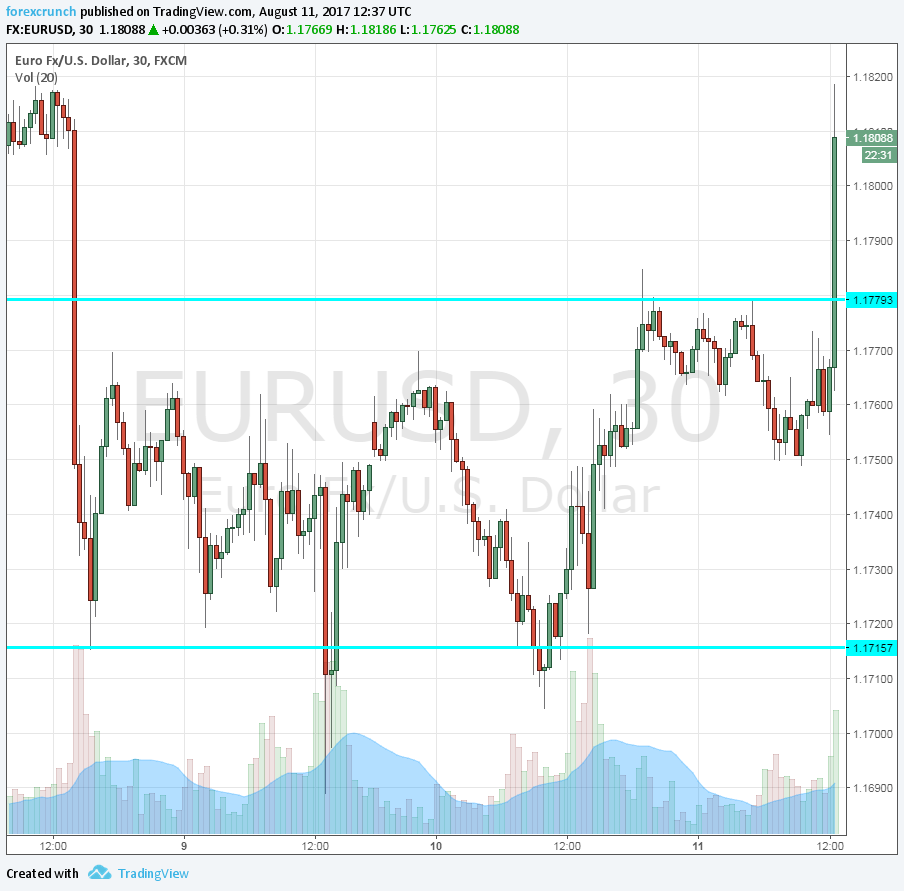

The US dollar sells off instantly.

The dollar fell to a sixteen-week low against the Japanese yen, but pared losses after Russian Foreign Minster Sergei Lavrov said there was a Russian-Chinese plan to defuse tensions between the United States and North Korea. “Goods prices, both headline and core and specifically in the USA, are going to rebound in the next three or four months”, he said in a video for clients last week.

Most economists are counting on a depreciating dollar, rising import prices and a tight job market to generate stronger price pressures across the economy.

Other declines were recorded in machinery and equipment, paper and plastics, auto parts, software publishing and portfolio management, among others.

While gasoline prices were unchanged after tumbling 2.8% in June, the cost of electricity increased 0.4%.

And wholesale costs for beef and veal fell 12 per cent, the largest decrease since October 1973.