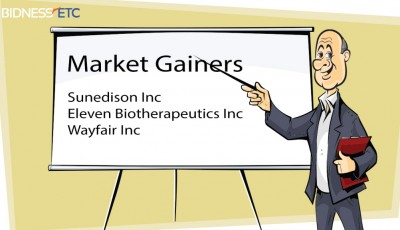

IPO News: The sun never sets on SunEdison’s solar assets

TerraForm Power Inc. will subsequently acquire Vivint’s rooftop solar portfolio, consisting of 523 megawatts to be installed by year-end, for $922 million in cash, according to the statement. SunEdison expects to issue approximately $370m of its common stock and $350m of SunEdison convertible notes to Vivint Solar stockholders as merger consideration.

SunEdison chief executive officer and TerraForm Power chairman Ahmad Chatila said: “SunEdison’s acquisition of Vivint Solar is a logical next step in the transformation of our platform after the successful execution of our First Wind acquisition in January”.

The residential network will be incorporated into TerraForm Power’s portfolio. Meanwhile, SunEdison’s existing RSC development business and the Vivint Solar team will be merged.

Maryland Heights-based SunEdison will pay Vivint shareholders $9.89 in cash, $3.31 in SunEdison stock and $3.30 in SunEdison notes for every Vivint share they hold.

The 523MW of residential solar projects are expected to provide a ten-year average unlevered Cash available for Distribution (CAFD) of US$81 million, and provide a ten-year average levered cash-on-cash yield of 9.5%.

“We want to accelerate how fast we penetrate that market”.

In premarket trading on Monday, Vivint’s shares were up 44%.

“As of the fourth quarter of 2015, our organic growth and recent acquisitions will put SunEdison on track to deploy more than 1 gigawatt per quarter”, he added.

In line with today’s announcement, SunEdison also initiated 2016 annual guidance of 4,200 MW to 4,500 MW, a 50% increase from its prior outlook of 2,800 MW to 3,000 MW.

The company has also entered into a commitment letter with Goldman Sachs Bank US for a $500m secured term loan facility.