Iranian OPEC Minister Begs Trump To Stop Tweeting

Their holdings are estimated at around 157bn barrels.

He has already emphasized that the sanctions which would be imposed on Iran would be “at the highest level”.

Left unmentioned by the Iranians and completely ignored by mainstream media is substantial evidence that the cause of the Iranian ire – Trump scrapping the nuclear deal fostered by the Barack Obama administration – was heavily skewed in favour of the Islamic republic, at the expense of American interests and security. Now it seems more reasonable and the oil curve indicates prices closer to the fundamentals.

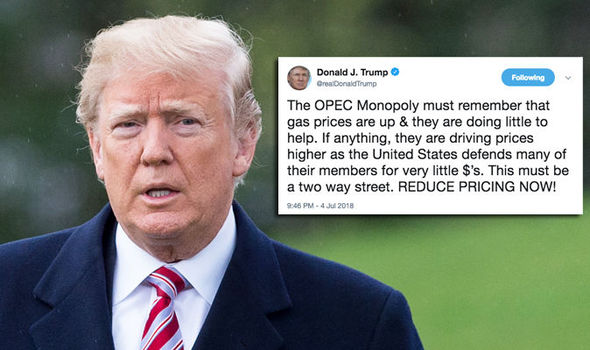

Trump’s advisers are clearly failing at their task, but Iranian officials tried to lend a helping hand by explaining the situation. While OPEC is facing mounting pressure from Trump to do more, America’s sanctions on group members Iran and Venezuela are adding uncertainties, just as USA tariffs on Chinese goods kick in on Friday.

The deal, which is due to run out at the end of 2018, has succeeded in boosting oil prices above $75 a barrel from below $30 a barrel in early 2016.

While trade concerns may be partly responsible for the decline, the industry was surprised to learn this week that oil stockpiles in the USA are getting larger, not smaller.

USA crude inventories probably declined by 5 million barrels last week, according to a Bloomberg survey.

The U.S. bank warned that supply threats were “threatening a sharp further rise in prices and global economic growth”. “If production increases as we now forecast, a large share of this would be eroded, leaving the global oil market with a limited “margin of safety”, said Morgan Stanley’s Rat.

“Just spoke to King Salman of Saudi Arabia and explained to him that, because of the turmoil & disfunction (sic) in Iran and Venezuela, I am asking that Saudi Arabia increase oil production, maybe up to 2,000,000 barrels, to make up the difference…”

Although Saudi Arabia is traditionally known for indirectly dictating most OPEC decisions, it is doubtful whether the Gulf state will have similar clout in current circumstances. The 12 OPEC members with supply reduction targets increased output by 680,000 bpd compared to May.

It remains a potent way to counteract Washington.

Meanwhile, Royal Dutch Shell’s boss has said it will be “foolhardy” for the oil and gas producer to set hard targets to reduce carbon emissions as it risked exposing the energy giant to legal challenges. Jimmy Carter struggled with high gas prices, which had doubled since the Iranian revolution.

Iran, OPEC’s third-largest producer, is facing USA sanctions on its oil exports that are prompting some buyers to cut purchases.

In the same time, European Union pledged to buy 1m bpd from Iran defying Trump and its parliament allowed to the European Union investment bank to work in Iran a day before the market waiting of imposing new US Tariffs can trigger series of retaliates to weigh down on the global recovery.

Financial institutions and experts have also pointed to Trump for driving up global prices.

“Please stop it, otherwise it will go even higher!” This will certainly affect Donald Trump and the Republican Party during the mid-term elections in November.

Saudi Arabia has wanted to sell shares in Aramco to bring in foreign investment to diversify its economy, but legal concerns about listing in places like London or NY have presented complications.

On Wednesday, an Iranian Revolutionary Guards commander said Tehran might block oil shipments through the Strait of Hormuz.