Iron Ore tests fresh lows below $50, leads commodities slump

As the commodity’s price falls, the world’s largest producers continue to ramp up their production rates to reduce their cost per tonnage, resulting in a massive supply and demand imbalance.

Australia’s Department of Industry and Science has forecast more ore and less demand will hold the price down at an average $54 a tonne this year and $52 in 2016.

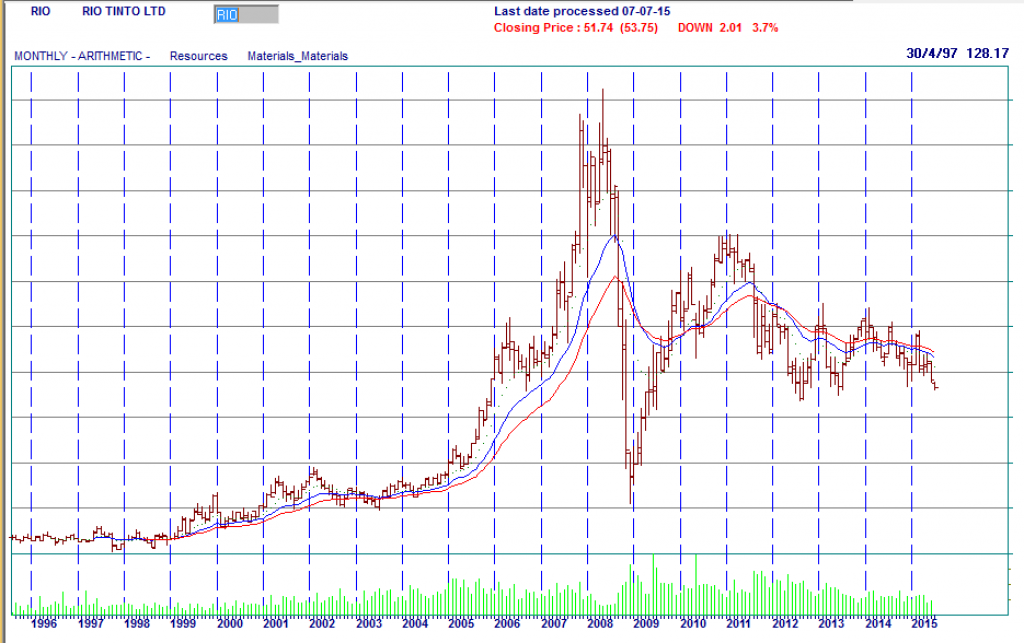

The iron ore price has tumbled to a new six-year low.

As Australia’s number one trading partner, a slowing Chinese economy and their tumbling share prices are not good news.

An analysis by global bank HSBC suggests the stock market wealth effect has less of an impact on consumption than many think, with less than 15 per cent of Chinese households investing in shares.

Atlas says it has already cut its breakeven price from $US60 since April, but there are doubts about whether costs in the sector can be further cut or how sustainable the lower costs are generally.

BHP, for its part, is shifting its focus away from iron ore and coal to copper and potash, resources that have a greater consumer focus. “And Australia’s experimentation with export controls in the 1970s and 1980s saw Japanese investment support Brazilian iron ore capacity instead of Australian”.

Revenue from the industry totalled more than A$430 billion ($321 billion) in the decade from 2005 to 2014, and this will rise to over A$600 billion in the next 10 years, even assuming no further output growth and prices staying at low levels.

Add in to this the mounting concern about the potential fallout from the Chinese stock market rout and it’s a crushing environment for iron ore producers.

“The slump in equities reflects a lack of confidence in China’s economy, which damps the demand outlook for industrial commodities”, Wu Zhili, an analyst at Shenhua Futures Co.in Shenzhen, said on Wednesday before the price data.

The report also makes the case that any form of intervention in the market to regulate supply would most likely end in failure and would be against the national interest. However, a meaningful recovery in commodity prices is not expected to happen before 2017, Investec notes.

There are really only two plausible explanations. It has since established a $50 break-even price, helped by a profit-sharing arrangement with contractors, and the last of its three mines reopened last week.

The price of iron ore is tumbling to levels which threatens to leave some junior miners unprofitable.