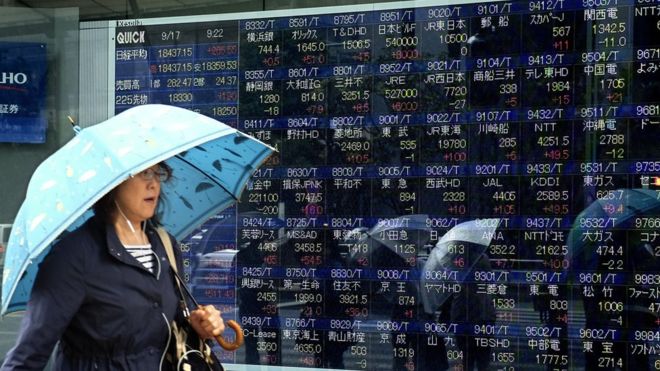

Japanese manufacturing confidence worsens

Sentiment among big manufacturers slipped in the most recent quarter, Japan’s central bank said Thursday, underlying the shaky footing for the nation’s economic growth.

Japan’s industrial output unexpectedly fell 0.5 percent in August, down for the second straight month, government data showed on Wednesday, underscoring concerns about tepid factory activity.

“The economic assessments by the government and central bank seem too optimistic”, said Mr Iwata, president of the Japan Center of Economic Research.

“The deterioration in big manufacturers’ sentiment was within expectations, while service-sector confidence rose and big firms revised up their capex plans”.

Analysts have warned over a return to contraction in the July-September quarter, after a contraction in the three months to June, owing to a slowdown in key trading partner China, weak consumer spending at home and soft exports.

Large companies also revised higher their planned capital investment for the business year ending March to a 10.9% increase from the previous 9.3% rise.

Big manufacturers based their plans on an assumption that the yen will average ¥117.39 to the dollar.

Economists had predicted that the index would worsen to plus 13.

“Weak factory output and today’s tankan won’t be enough for the BOJ to ease policy soon”. 7, while that of inventories was up 0.4 percent to 114.1.

Mr Abe on September 24 pledged to expand the world’s third-largest economy by 20% without elaborating on how and by when.

That compared with the median estimate of plus 13 in a Reuters poll of economists. The outlook score was 19 versus, matching forecasts and down from 21 in the second quarter.

The decline was led by lower output of construction machines, air conditioners and automobiles.

Twenty-two of 35 economists predicted Kuroda will have to bolster already unprecedented stimulus, with 11 forecasting this will occur October. 30 when the bank reviews its inflation outlook, according to a Bloomberg survey conducted from September 7 to 10.

These levels would need to be taken out for a retest of larger resistance in the form of twin peaks at Y121.75, seen August 28 and August 31.