Jeb Bush: Make Tax Laws “Simple, Fair and Clear”

Democrats who describe Jeb Bush’s tax plan as “trickle-down economics” say many benefits will flow to the candidate himself.

And unlike some Republican proposals, he didn’t bury it deep within a dense white paper as a way to make the numbers add up-he hasn’t said how much his plan will cost, by the way. A third New York Times piece even made the direct comparison to Sen.

“There’s a lot to like in the plan, if you were to compare maybe to some other things that could bring in the same amount of revenue”, Viard said. You simply can’t tax “the 1%” enough to pay for the promises of the welfare state, which is why the European social democracies tax everybody very heavily through regressive consumption taxes such as the VAT.

Mr. Bush’s plan would increase the standard deduction substantially, from $12,600 for married filers to $22,600.

As Barton Gellman details in Angler: The Cheney Vice Presidency, when it came time to push the tax platform through Congress, Cheney outmaneuvered George W. Bush to secure an additional capital gains tax cut dramatically favoring the rich. Bush thought such a cut would be seen as a slap in the face to supporters who had believed his “compassionate conservative” campaign pitch, but Cheney won the legislative battle. Jeb Bush is proposing to reduce tax brackets from 7 to 3 at 28 percent, 25 percent and 10 percent.

He also said the plan would expand the earned income tax credit, a tax credit aimed at providing tax relief to the working poor, and cut corporate taxes.

Bush’s challenge will be convincing voters that those changes represent a fundamental, rather than an incremental, improvement on Romney’s tax plan. “I think Republicans need to just take a step back and show a little self-restraint and let this happen a little more organically”, said Bush, according to Politico.

Part of the Republican presidential candidate’s proposal would be to cap deductions that individuals can claim on their tax returns to lower their taxable income. He says he is confident this tax plan will work because he used a similar model in the past. As always, Bush counts on tax cuts to miraculously stimulate the economy and create more jobs.

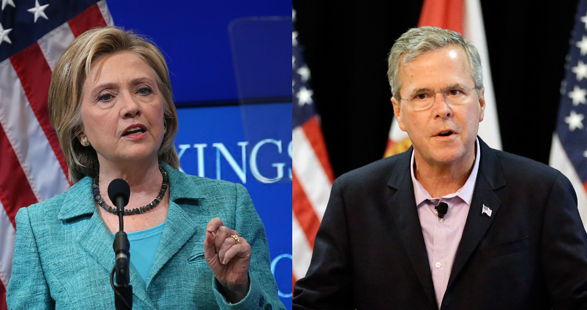

Bush’s plan also adopts an idea already endorsed by Republican presidential frontrunner Donald Trump and Democratic frontrunner Hillary Rodham Clinton to repeal a substantial loophole for managers of hedge funds and private equity investments known as “carried interest”.

Without naming Trump, Bush called for more thoughtful policy debate on the campaign trail.

It advances what he called President Barack Obama’s agenda of “low growth, crony capitalism and easy debt”, he wrote.

Bush said that his plan, along with other efforts such as regulatory relief, would double the nation’s economic growth to 4% and create 19 million jobs, growing the tax base. He also wants to eliminate the interest deduction for business loans.

With this reform in place, roughly 15 million Americans will no longer bear any income-tax liability.

The Tax Foundation, which even for a right-leaning organization is unusually optimistic about the ability of tax cuts to spur growth, thinks all this would do wonders for the economy.

I’ll never vote for Bush3 or another Clinton. I’d rather pet a rattle snake with a “pet me” sign.