Jindal Campaign Jokes: Trump’s Tax Plan ‘Really, Really, Really Fantastic’

The Wall Street Journal recieved an early copy of the plan, which features a rate of 0 percent for individuals making less than $25,000 in annual income.

What will they do instead? This would remove more than half of households from the income tax rolls altogether, he says. They get a new one page form to send the IRS saying, “I win”, those who would otherwise owe income taxes will save an average of almost $US1,000 each. Even with big cuts to income tax, letting freelancers pay only 15% tax on their earnings would create a sharp and unwelcome incentive to masquerade as self-employed. He suggested that he will raise taxes on the rich, but proposes a “substantial reduction” for the middle class. Individuals earning more than $150,000 will see their marginal tax rate fall from close to 40% now to 25%, three percentage points lower than under Mr Bush’s plan.

He’s also slashing the corporate tax rate to 15% from 35% – which could be a windfall to his multi-million dollar businesses. And he would phase out the tax exemption on interest from life insurance policies and eliminate the tax preference on carried interest for hedge fund managers.

He said the plan would bring the government the same or more revenue as current tax rates, and pushed back against the idea that he was breaking with the Republican Party by calling for higher rates for some wealthy earners.

But many of those would vanish under a Trump administration, according to his tax plan, thus increasing the amount of taxes Trump would need to shell out. In a press alert about the plan, the campaign states, “Essentially, the plan is a major tax reduction for nearly all citizens and corporations, in particular, those in the middle and lower income classes”. “Maybe let Russian Federation do it. Let them get rid of ISIS”, Trump told the USA news program.

Trump remains in first place in the Washington Examiner’s presidential power rankings. That appeared to strike a populist note, but many voters at those income levels already do not pay federal income taxes.

The real estate mogul has proposed a variety of tax overhauls over the years, including some that have raised eyebrows from groups like the tax-cutting advocacy group Club for Growth.

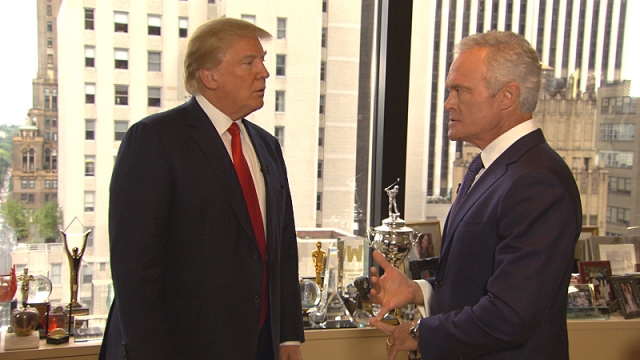

His tax plan is the only the third major policy proposal from Trump, who has also outlined plans for immigration and guns. On Trump’s plan to expel the roughly 12 million illegal immigrants in this country, he promised his government would be “rounding ’em up in a very humane way, in a very nice way”. “And frankly I don’t call it thin-skinned – I’m angry”, Trump said, adding that he could take criticism “if it’s fair”. Pelley pointed out that politicians on both sides of the aisle don’t seem especially fond of the brash businessman and probably would be slow to approve some of Trump’s plans.