Legal Challenge Filed Against Application Of Chicago’s ‘Amusement Tax’ To

Angry streaming customers in Chicago are fighting back against the so-called “Netflix tax”, filing a lawsuit against the city last Wednesday that could have national implications, the Daily Dot reports.

In their recent complaint against Chicago, however, the plaintiffs charged that the city’s amusement tax “unlawfully discriminates against electronic commerce because it imposes a higher tax rate on theatrical, musical, and cultural performances that are delivered through an online streaming service than it imposes on those same performances if they are consumed in person”. At the time, we figured the people of Chicago would just get over it, put the tax on their famously broad shoulders, and move on with their lives.

It’s been reported by the Chicago Tribune that the cloud tax is expected to bring in $12 million annually to the city, and that it is part of a larger attempt to ease budget problems by Mayor Rahm Emmanuel.

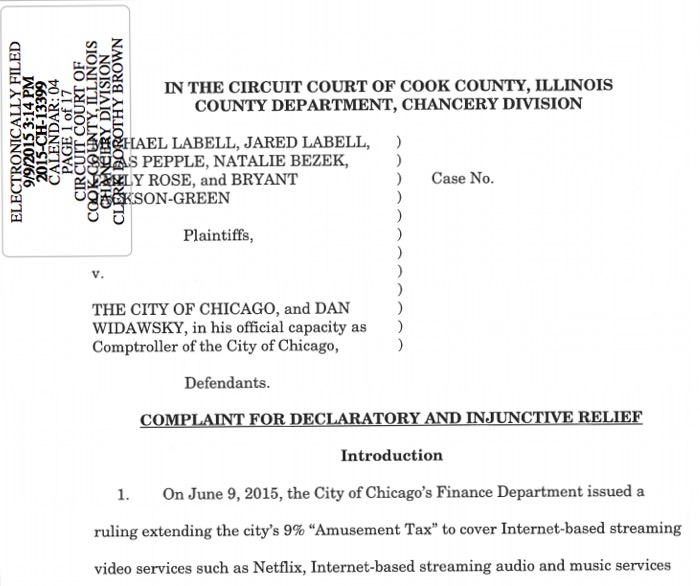

The group of plaintiffs want the court to declare the amusement tax in violation of overarching federal and further enjoin the applicable officials from enforcing the tax. Inside the lawsuit, those against the tax lay out their case.

The lawsuit contends that the tax extension, ordered by Chicago’s comptroller, is illegal because the original law does not specifically include Internet-based streaming media services.

Why this matters: The sextet suing the city of Chicago is demanding that the tax be withdrawn.

Up until now, the issue of taxing streaming video and audio has been much less controversial than that of the question of whether states should be able to force out-of-state, online retailers to collect sales taxes. According to their complaint, Widawsky has “exceeded his authority” in implementing the tax because Chicago’s municipal code does not “authorize the comptroller to impose new taxes that the city council has not authorized through a city ordinance”. It’s not fair or legal that you pay the tax for streaming a movie on Netflix but not for the DVD, they argue.