MasterCard Selfie App Verifies Online Payments

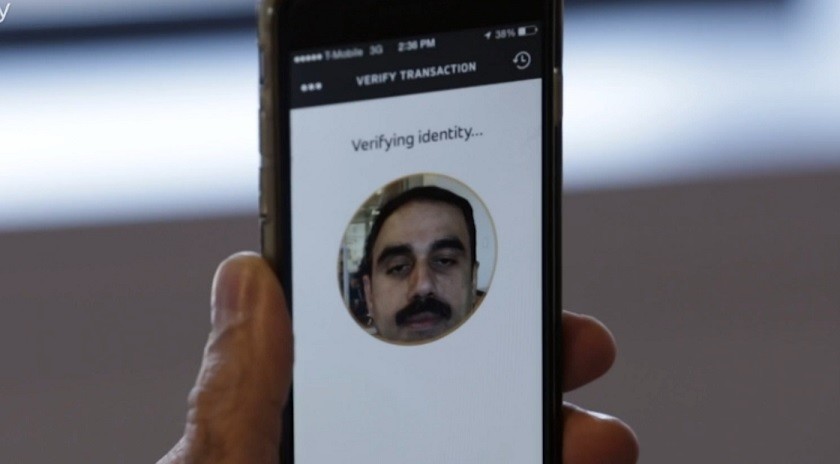

In the latest, and perhaps most weird, effort we’ve seen to stem the incidence of mobile fraud, MasterCard is working on a new security scheme that would authorize online transactions by having users take a photo of their face as a means to verify their identity. Let’s say, for example, you’re trying to prove that you’re the owner of the device that’s being used to buy something. With many of today’s young consumers seemingly obsessed with selfies, MasterCard hopes that the plan will be well-received by Millennials.

MasterCard is testing new technology to improve security for online payment gateway transactions. But for now, it’s the trial of facial and fingerprint scanning to look out for – you might be using your face to make your next purchase.

The app doesn’t send either your fingerprint or a picture of your face to MasterCard.

This fall, MasterCard will pilot a new smartphone app that uses facial recognition technology to verify customers’ identities, and if successful, could roll out the scheme to customers worldwide.

MasterCard created this system together with the partnership of Apple, Google and Samsung. That’s not necessarily foolproof however as it could theoretically be possible to take a photo of somebody and animate it with a few frames featuring bogus eyelid images. “But there is a case for adding extra layers of security”.

The credit card company is now using a password system called “SecureCode” in the last step of online shopping to verify a customer’s identity.

Users will have to download the MasterCard phone app. When making a purchase, a pop-up will ask for authorisation, either fingerprint or facial recognition. They can get compromised; you can forget them.

Drop This Fact: There are around 30 churches in the world that use the facial recognition software “Churchix” to track whether congregants attend services. Another potential security feature is voice recognition, which may allow users to make purchases just by speaking to their phone. Though this stops credit-card-number-stealing hackers from actually using users’ card on the Web, passwords get forgotten, stolen, or intercepted.