Medicines Co. Shares Surge on Cholesterol-Drug Data

In early trading indications, shares were up 6.4% to $116.00.

The results from The Medicines Company’s recent Phase 1 clinical trials found that ALN-PCSsc has the ability to reduce LDL-C by up to 83%. (NASDAQ:REGN) and Sanofi SA (ADR) (NYSE:SNY), won the US Food and Drug Administration (FDA) approval past July.

On the other hand, say the partnered developers, a 2x or 4x annual dosing schedule would also line up neatly with a patients’ need for regular updates on exactly how well they’re doing on lowering bad levels of LDL. Similar reductions in LDL-C were seen in patients on and off concomitant statin therapy.

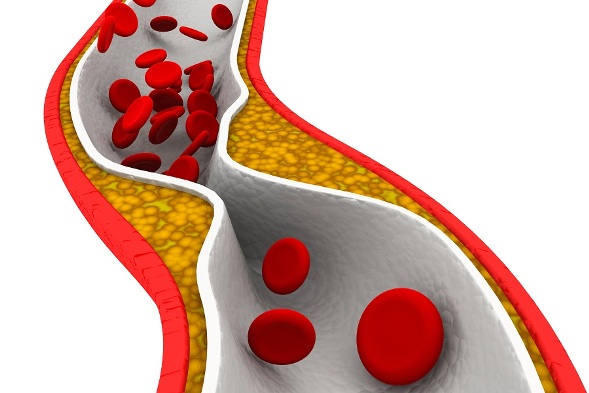

The drug is being co-developed by Alnylam Pharmaceuticals and the Medicines Co. In contrast to anti-PCSK9 monoclonal antiboard of directors ies (MAbs) that bind to PCSK9 in blood, ALN-PCSsc is a first-in-class examinational medicine that acts by turning off PCSK9 synthesis in the liver. Those studies will be larger and focus on the drug’s potential effectiveness. At higher drug exposures of 500 mg or greater, four subjects receiving ALN-PCSsc reported mild, localized injection site reactions that resolved without medical intervention.

Pfizer Inc. (NYSE:PFE) and Esperion Therapeutics Inc. Esperion’s ETC-1002 has the advantage of being an oral drug. The companies disclosed that its drug candidate was effectively able to cut off the production of the PCSK9 protein which in turn led to bad cholesterol.

Cost is a major issue for PCSK9 drugs, with Repatha and Praluent priced at more than $14,000 a year, before discounts. Piper Jaffray now has an overweight rating on the biopharmaceutical company’s stock. Analyst Gbola Amusa advised investors to be “more selective in the biotech space”, saying that since Regeneron is now trading at 95% of its price target on the stock, it warranted a downgrade.

What: Shares of The Medicines Company (NASDAQ:MDCO), a drugmaker that specializes in developing medicines indicated for patients in acute and intensive care settings, saw its shares rise by more than 20% on exceptional volume today. The index shed 3.25% during the same timeframe.

How Factors Effect On Stocks’ Performance?

Several research firms recently commented on ALNY. Analysts at the FBR Capital have a current rating of Outperform on the shares. The company has a market cap of $8,708 million and the number of outstanding shares have been calculated to be 84,615,000 shares. During the same quarter in the previous year, the company posted ($0.63) EPS.

Alnylam Pharmaceuticals, Inc. has dropped 16.87% during the last 3-month period.

“It’s a novel concept and it’s very encouraging” data, Williams said. “We anticipate Regeneron will share in the economics from $7.6 billion of Eylea sales in 2020 from its partnered ophthalmology franchise”. Deutsche Bank set a $155.00 target price on shares of Alnylam Pharmaceuticals and gave the stock a buy rating in a research note on Wednesday, June 24th.

Alnylam is reporting Phase I data at the European Society of Cardiology (ESC) Congress this morning for ALN-PCSsc that tackled a big slate of goals with a small set of patients.