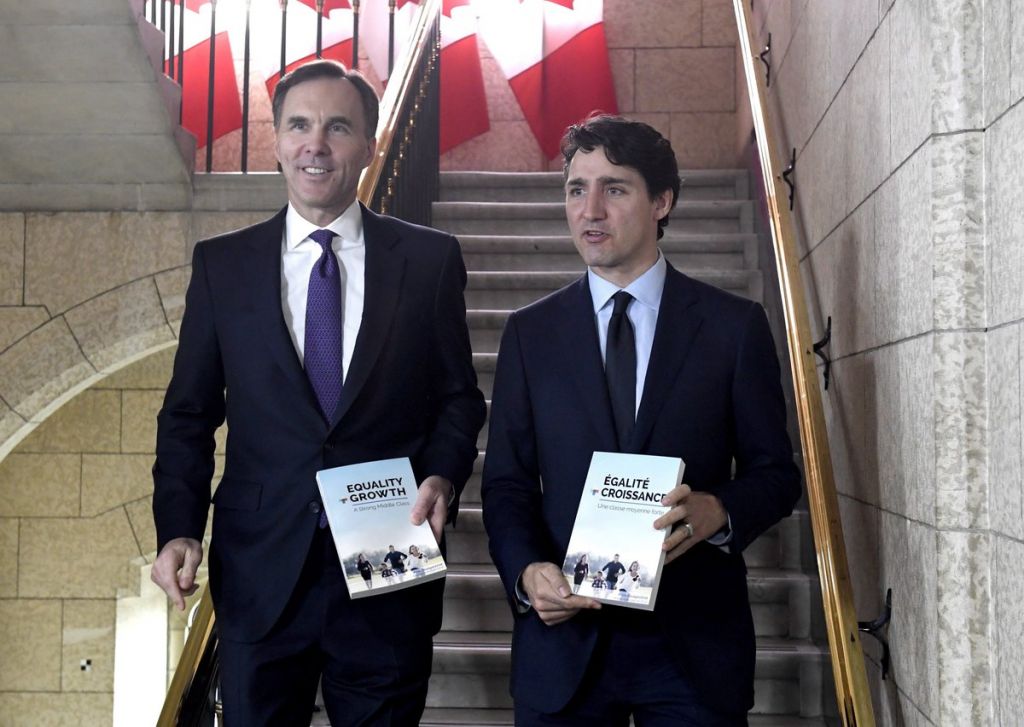

Morneau defends budget, says Ottawa must play both short and long game

With persistent deficits, which are essentially deferred taxes, Canadians are left wondering by this budget how much in taxes they will pay this year and in the future-further impeding investment and entrepreneurship.

Small business owners now sock away some of their earnings into investment vehicles and the earnings are taxed at the lower small business rate.

The federal budget is expected to include a five-week, “use-it-or-lose-it” incentive for new fathers to take parental leave and share the responsibilities of raising their baby.

– Changes to income sprinkling, passive investment income and the small business tax rate that are expected to save the government $925 million a year by 2022-23.

Today, we’ll stress test Morneau’s budget and his strategy for managing the risks confronting us from beyond our borders. And the government’s average annual increase in program spending (6.3 per cent) has dwarfed growth in revenue (3.3 per cent), inflation plus population growth (2.7 per cent), and growth in nominal gross domestic product (2.6 per cent).

By Thursday Morneau faced fury in the House of Commons from the NDP who say Morneau has “sabotaged” and “vandalized” the plan for universal coverage endorsed at their national convention two weeks ago.

“Unemployment rates are near the lowest levels we’ve seen in over 40 years”.

The government has implemented a watered-down version of reforms for “tax planning”. He reaffirmed the balanced budget commitment shortly after taking office. It said the Government should eliminate the “half-year rule”, to enable businesses to claim in the first year the maximum depreciation deduction otherwise available, as opposed to only one half.

But it’s not like the Trudeau Liberals need to cut spending as much as the Chretien Liberals did.

In fact, the “running theme” of the 2018 budget seemed to be focused on early career researchers, says Tina Gruosso, vice president of communications for Science & Policy Exchange, a Montreal-based campaign group run by graduate students and post-doctoral fellows. “The deficit is less than 1% of GDP”.

“In contrast, in the United States, theirs is going upwards sharply and it is not sustainable, whereas I think our is extraordinarily sustainable on the path that we’re on”.

The document outlined plans for 21.5 billion Canadian dollars in new spending, which will result in a deficit of 18.1 billion dollars next year. It contains no major spending announcements for things like child care or transportation infrastructure.

The Liberal government moved to tighten the tax rules for small businesses in the federal budget Tuesday as it fine tuned the changes that prompted an uproar a year ago.

The investment pledge is the largest cash injection for science research in the country’s history, demonstrating and effort from Ottawa to modernise the country in an innovative global climate. The budget predicts the ratio to decline each year over the outlook.

The Liberals have also put this budget through a gender-based analysis, which involves thinking about how a certain measure might affect men and women, or boys and girls, in a different ways, while accounting for other intersecting factors such as income, ethnicity, disability and sexual orientation. “And that includes Canada’s talented, ambitious and hard-working women”. “The goal of this investment will be to better support early-career researchers, while increasing diversity among nominated researchers, including increasing the number of women who are nominated”, the budget noted. But C$7.2 billion was moved out of previous years, the current year and the fiscal year that begins April 1.

“The women in this country who have the most hard time economically are women who are parenting alone”, she said.