Netflix, Inc. (NFLX) Raises Q2 Guidance As Subscriber Numbers Beat Street Estimates

The company maintains price to book ratio of 2.91. (NASDAQ:NFLX) on Tuesday, February 13. Zacks Investment Research’s earnings per share averages are a mean average based on a survey of analysts that that provide coverage for Netflix.

Shares were up 6.4 percent at $327.47 after hours. The rating was maintained by RBC Capital Markets on Thursday, March 15 with “Buy”. The firm has $360.0 highest while $93.0 is the lowest [Target].

Sell-side analyst recommendations point to a short term price target of $21.23 on the shares of Flex Ltd. (FLEX).

Total analysts of 31 have positions in Netflix (NASDAQ:NFLX) as follows: 19 rated it a “Buy”, 1 with “Sell” and 11 with “Hold”.

Deutsche Bank’s Bryan Kraft: Buy rating, $350 price target. (NASDAQ:NFLX) by some 20,021,391 shares, 378 decreased positions by 28,628,738 and 155 held positions by 306,266,691. Cetera Lc invested 0.15% of its portfolio in Netflix, Inc.

Netflix’s value – the most popular plan now costs $10.99 monthly, $13.99 gets you 4K video – really depends on how good the service is compared to its competition, said CEO Reed Hastings during an interview Monday after the company released its first-quarter financials.

In the first quarter, Netflix added 7. There are consensus estimates calling for $0.64 in EPS on $3.69 billion in revenue.

The Los Gatos, CA-based streaming media giant reported Q1 EPS of $0.64 per share, which came in at $0.01 above the Capital IQ Consensus of $0.63. The company’s revenue for the quarter was up 35.9% on a year-over-year basis.

Yet a growing segment of the population forgave and forgot, replacing live TV services with Netflix’s on-demand library, even as the company’s average US subscription price rose 12 percent in the past year. The stock was sold at an average price of $220.99, for a total value of $524,409.27.

Institutional investors now hold around $109.76 billion or 83.4% in NFLX stock. The disclosure for this sale can be found here.

According to Eldorado Resorts, Inc.’s Insider ownership is at 0.90%.

Several hedge funds have recently added to or reduced their stakes in NFLX. Moreover, Edge Wealth Mngmt Limited Liability Co has 0.02% invested in Netflix, Inc. Viking Global Investors LP increased its stake in Netflix by 145.5% in the fourth quarter.

The company, the best-performing stock in the S&P 500 this year, is proving one quarter at a time that investors’ confidence in its online TV service has been justified.

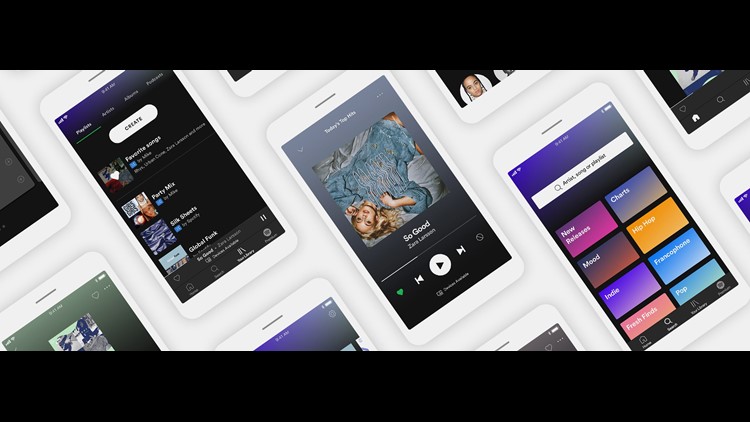

Many investors still believe Spotify has a chance to become the Netflix of video streaming. Almost 5.5 million of these subscribers were from outside the U.S., as its worldwide market continues to see growth. Finally, Xact Kapitalforvaltning AB grew its position in shares of Netflix by 9.4% during the 4th quarter. Moreover, Mitsubishi Ufj has 0.42% invested in Netflix, Inc. The company in its report today said it expected to spend between $7.5 billion and $8 billion on original content, and expects that marketing and content spend to weight toward the second half of 2018. The Domestic streaming segment includes services that streams content to its members in the United States.

Netflix also reported a 43 percent increase in revenue year over year, “the fastest pace in the history of our streaming business” due to a 25 percent increase in average paid streaming memberships.

To view Vetr’s full report, visit Vetr’s official website.