New SEC Rule Could Make Life Awkward for CEOs

These concerns are one key reason why the rule, which was made law as part of the Dodd-Frank Act five years ago, took so long for the SEC to formally adopt.

Smaller public companies – those with less than $75 million in total shares held externally or less than $50 million in annual revenue – are exempt from the disclosure.

Warren cited the SEC’s slowness to finalize the rules requiring disclosure of the ratio of CEO pay to the median worker as among White’s failings. More than 1,500 were individual letters, and the rest were form letters, SEC Commissioner Luis A. Aguilar disclosed in a written statement.

Moreover, some in the business community say that the information won’t be helpful to investors.

“Business interests such as the U.S. Chamber of Commerce have lobbied against the requirement”, the AP reports, “saying it will be costly and time-consuming for companies to gather the information”. Opponents of the measure countered that the disclosures would add no information of value and that they would be expensive to implement. “Repealing the pay ratio rule … would allow companies to find more productive uses of their time and money so they can invest in the future and create jobs”.

Under the final version of the regulation, companies will have some latitude to determine which of their employees factor will into their calculations, as well as the methodology for estimating total compensation.

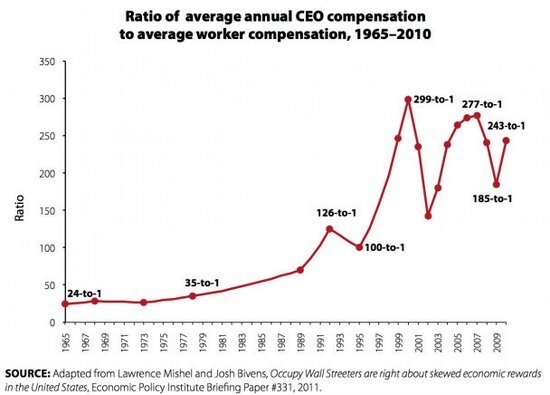

CEO compensation has exploded over the past 50 years according to research by the Economic Policy Institute (EPI), a progressive think tank with ties to the American labor movement. “I can only conclude that there is no reasoned basis for the commission’s action”.

“To steal a line from [Supreme Court Justice Antonin] Scalia, this is pure applesauce”. (See full statement).

It’s worth noting that the requirement for gathering and reporting median employee earnings, likely to impact HR departments, also applies to foreign companies that are listed on the US stock markets.

Nobody’s proposing limiting CEO pay to a certain figure, like the Swiss tried to do in 2013, with a failed referendum that would have capped chief executive pay to 12 times that of junior employees. Companies are permitted to identify the median employee once every three years unless changes intervene that would significantly affect the pay ratio.

Heather Slavin Corzo, a director at the AFL-CIO, said she was pleased that the SEC completed the rule but remained concerned about “weaknesses that could lead to loopholes”, including letting companies exclude a portion of their overseas workers from the median. “This simple benchmark will help investors monitor both how a company treats it average workers and whether its executive pay is reasonable”. “This proposal has the potential to drive up compliance burdens and costs for public companies with no benefit to investors”, Hirschmann said back in 2013.The delay frustrated supporters of the rule. Sen.

Under the new rules, companies will be required to disclose median worker pay-the point on the income scale at which half their employees earn more and half earn less-and compare it with CEO compensation.