No Surprises in Rankings of States’ Fiscal Solvency | PJ Tatler – PJ Media

The Beehive State is among the more financially healthy in the country, according to a new report. “While no ranking can capture all of a state’s fiscal dynamics, these can serve as a tool to guard against short-term and long-term risks or economic shocks”.

More gloom on the Empire State’s economic health came this week with two reports comparing New York’s fiscal outlook to that of the other 49 states.

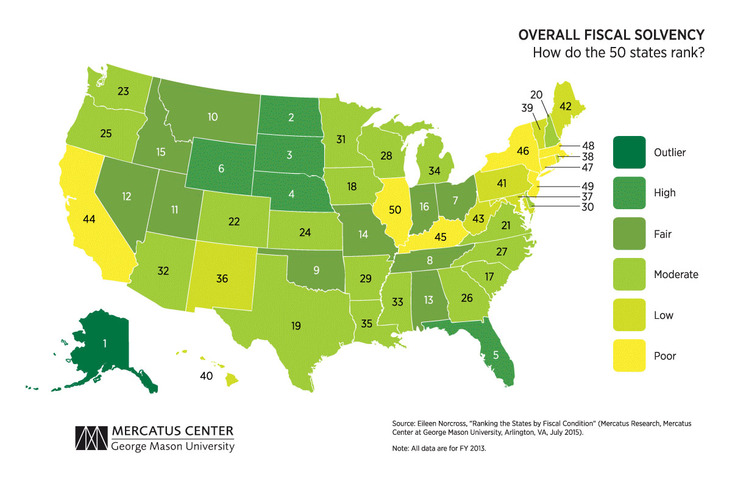

In a new map by the Mercatus Center, all 50 states are ranked by their overall fiscal solvency. “We’re looking at the whole fiscal picture – assets to liabilities”.

Democratic legislative leaders, meanwhile, have opposed new reforms, and last month Christie rejected their attempts to bring in more revenue for the pension system by increasing taxes on corporations and high-income earners.

Understanding how each state performs in a variety of fiscal indicators can help local policymakers during the decision-making process, Norcross added. But its long-term financial health looks precarious.

The conservative-leaning Mercatus Center – “mercatus” in Latin means “market” – judged the states on five different categories, including whether they are bringing in enough revenue to pay bills and if they are keeping enough cash on hand to cover those bills.

Utah was fourth in budget solvency – which measures whether a state could cover its fiscal year spending using current revenues.

In terms of long-term solvency, though, red states have a huge upper hand on blue states.

“””(Utah) is in the middle”, Norcross said.

Service-level solvency. How much fiscal “slack” does a state have to increase spending should citizens demand more services?

But all this comes after Albany finished up for the year without even talking about any major effort to boost the economy – nothing to slash tax rates or, say, lower far-too-high electricity rates. “””(Utah) was average”.

At $2,946 per capita, the state’s debt load is more than 50 percent higher than the national average, $1,824 per person.

Norcross said the study overall showed Utah is relatively strong in terms of its ability to cover its short- and long-term liabilities.

But Erica Klemens, state director of the conservative Americans for Prosperity organization in New Jersey, said the Mercatus study “makes clear that the very future of our state and the quality of life for our residents is at risk unless the state’s pension crisis is addressed”. “It’s not unique to Utah”.