Nvidia beats Q2 financial expectations due to strong GPU sales

NVIDIA (NASDAQ:NVDA)’s stock had its “hold” rating reiterated by investment analysts at Barclays in a report released on Saturday, Marketbeat.com reports. The standard deviation of short term price target has been estimated at $3.28, implying that the actual price may fluctuate by this value. Pacific Crest reissued an equal weight rating on shares of NVIDIA in a research report on Tuesday. I suspect that the problems here are more secular (i.e., weak overall workstation market) than company specific (i.e., share loss), but would like to see a return to year-over-year growth here sooner rather than later as this is quite a high-margin business segment for the company. Two investment analysts have rated the stock with a sell rating, fourteen have issued a hold rating and eleven have given a buy rating to the company’s stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this hyperlink. The firm has a market-cap of $12.36 billion and a price-to-earnings ratio of 20.52.

He upgraded Nvidia to buy and increased his price target on Nvidia stock to 26 from 25. Analysts had expected a fall to $1.10 billion.

For one thing, Nvidia is still in the process of writing down its Icera wireless modem business, which in May it said it would scrap after failing to find a buyer for it. It ate $103m in restructuring and other charges in Q2 related to that wind-down, and it said it expects to write down another $15m to $25m in the third quarter.

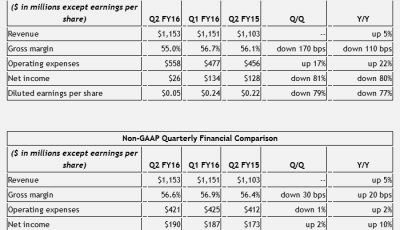

Revenues for the quarter climbed to $1.15 billion from $1.10 billion a year earlier.

Revenue in the period that ends in October will be $1.18 billion, plus or minus 2 percent, the company said Thursday in a statement. During the same quarter in the prior year, the company posted $0.30 EPS. “Following the updated outlook, our CY15E/CY16E EPS move from $0.68/$0.84 to $0.78/$1.00, respectively”. The ex-dividend date is Tuesday, August 18th.

About NVIDIA Since 1993, NVIDIA (NASDAQ: NVDA) has pioneered the art and science of visual computing. The Business is engaged in creating NVIDIA-branded products and services, offering its central processing units to original equipment manufacturers (OEMs), and licensing its intellectual property. NVIDIA- services and branded commodities are visible computing platforms that address four markets: Enterprise, Gaming, High Performance Computing & Cloud, and Automotive.

Nvidia has also been increasing its focus on making chips that allows people to play graphics-heavy games over the internet and chips used in a car’s dashboard display and in self-driving cars.

The company also experienced strong growth in the customer base for Nvidia Grid graphics virtualization.