Official estimate could upend Trump tax plan

The White House will release a formal proposal tomorrow to cut the tax rate from 35% to 15%, part of the Trump agenda to boost the economy and create jobs in the US.

The top tax rate for individuals would be cut from 39.6 percent to the “mid-30s”, one official said.

President Ronald Reagan’s 1981 tax cut reduced federal revenues by nearly 19 percent, according to a Treasury report.

Trump’s chief spokesman says the wall remains a top priority for the president.

And, for the previous 90 days or so, all of the reporting coming out of the White House made clear just how important Trump viewed the 100-day mark. “All these rates, if we’re going to go bold, will be a challenge”. Some lawmakers have expressed concerns that Trump’s call for a big corporate tax cut would balloon the almost $20 trillion in long-term debt the USA has accumulated if there are not corresponding measures to raise more revenue.

“We share Chair Hatch’s skepticism as we see neither the political will nor the procedural path to securing a 15% corporate rate”. He also confirmed that the White House would call for allowing millions of small businesses to also take advantage of this lower rate, though he said certain protections would be put in place to prevent high-earners from gaming the system to lower their personal taxes. “Because they earn so much, they’re in a higher tax bracket, and because they’re able to spend more on child care, they’re also able to deduct more”, Hamm says.

“I mean, business shouldn’t have anything to do with families”, said poll respondent Debbie Bolton from Erlanger, Kentucky, referring to the role of government as caretaker and helper. Paul Ryan has been trying to pass a revenue-neutral plan, which would cut taxes on the rich and raise them on the non-rich by imposing a border-adjustment tax. Many U.S. corporations, especially large multinationals, already pay well below the statutory 35-percent tax rate, but have been campaigning for a formal rate cut for many years. A properly structured tax-rate reduction to 15% with a reform of the tax code to eliminate its anti-competitive complexities and rent-seeking deductions would make America more competitive and innovative both at home and overseas, and need not carry the cost that the Washington Post assumes. It significantly dropped income tax rates and added a host of other tax-decreasing changes. He also thinks a lower corporate rate would unite the Trump White House’s business-leaning and nationalistic wings.

However, Treasury Secretary Steven Mnuchin has repeatedly pledged that the administration’s tax plan will pay for itself.

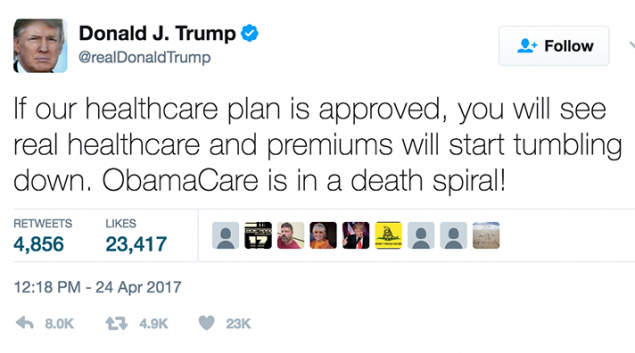

Trump has struggled to advance his domestic agenda, including taxes.

Trump dispatched his top lieutenants to Capitol Hill Tuesday evening to discuss his plan with Republican leaders.

“Unlike his predecessor who abused executive authority to expand the size and scope of the federal government in an end run around Congress, President Trump is using his legal authority to restrain Washington bureaucrats”, said White House spokeswoman Sarah Huckabee Sanders.

“I’m not convinced that cutting taxes is necessarily going to blow a hole in the deficit; I actually believe it could stimulate the economy and get the economy moving”, Hatch said. “Even seemingly simple approaches can be very hard to work out”. That if you elected someone who knew their way around a boardroom, you’d see a rapid improvement in peoples’ quality of life.

Importantly, the Trump plan was not expected to include any specific proposals for raising new revenues to offset revenue losses that would result from tax cuts. It has yet to find funding and will clearly require a battle with Congress, where many members, including Republicans, oppose it.

“As a country we shouldn’t accept a tax code that a favors foreign workers and foreign products over American workers and American products”, he said. “The border adjustment provision isn’t just a pay-for, it is about leveling the playing field and taxing all products and services equally”.