Oil falling amid fears for global economy, WTI drops nearly 5%

To help maintain liquidity in the mortgage market, the committee will continue to reinvest principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities, as well as rolling over maturing Treasury securities at auction. “I am not arguing that the economy is ideal, but nor is it on the ropes, requiring zero interest rates to get it back into the ring”.

At a closely watched meeting, Fed officials voted nine to one to keep the benchmark Federal funds rate range unchanged between 0 per cent and 0.25 per cent. “However, in light of the heightened uncertainties overseas and a slightly softer expected path for inflation, the committee judged it appropriate to wait for more evidence”, said Yellen.

An economic environment in which the Fed feels it cannot end the era of near-zero interest rates is not one likely to foster the kind of earnings growth needed to support stocks at their current, above-average valuations.

“The market is doubting whether or not the Fed is going to hike rates in December”, said Marc Bushallow, director of fixed income at Manning & Napier in Rochester, New York.

The Federal Reserve ended weeks of speculation Thursday by keeping us interest rates at record lows in the face of threats from a weak global economy, persistently low inflation and unstable financial markets.

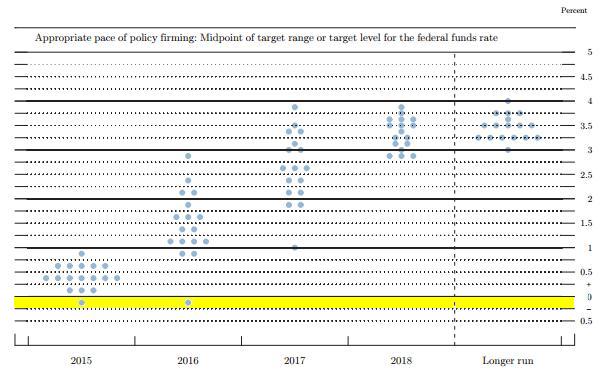

However, the bank could still raise rates before year-end, with 13 of 17 Fed policymakers expecting it a hike this year.

The Fed meets again in late October.

With an eye on declining energy prices and mindful that global financial pressures were restraining economic activity, the Fed said its outlook was “nearly balanced” but it would be watching worldwide developments.

However, her multiple references to China and the Fed’s inaction speak louder than any efforts she makes to soothe markets.

The global slowdown emanating from Europe and China has recently thrown financial markets into turmoil, a risk specifically raised by the Fed in its statement Thursday. Its forecasts for GDP growth in 2016 and 2017 were downgraded, while the Fed’s Funds Rate forecasts were also lowered to 3.5% compared to 3.75% at the previous policy meeting.

The Federal Reserve, however, noted that it’s possible that rates could remain beneath “normal” levels even once employment and inflation numbers stabilize.

The Conference Board’s leading economic index inched up 0.1 percent in August, while revised data showed no change in July.

For emerging markets, especially in Africa, a hike in interest rates could be grave.