Oil prices down on resurgent supply glut worries

From the desk of Evdokia Pitsillidou, Risk Management Associate at easyMarkets.

In June, global oil supply grew by 600,000 barrels a day to 96 million barrels a day, the International Energy Agency said in its latest oil report.

USA benchmark West Texas Intermediate for delivery in August was down 28 cents, or 0.61 per cent, to US$45.40 and Brent crude for September eased 27 cents, or 0.57 per cent, to US$47.10 a barrel at around 0600 GMT.

US gasoline stocks and European diesel inventories have risen in recent weeks despite entering the peak seasonal summer demand period as refineries continue to pump out at near maximum levels. The MACD also shows continuing declining momentum. Prices Wednesday suffered a hefty loss, which caused the week-to-date performance of oil to turn negative.

Since July 5, USO rose along with crude oil futures. These forces have investors convinced that oil prices are not sustainable above $50 a barrel, despite declining production in the United States.

The EIA said crude inventories fell 2.5 million barrels last week, less than a 3-million-barrel drop forecast in a Reuters poll. For the time being, however, energy traders focused on reports of swelling supply levels among top OPEC producers such as Saudi Arabia and Iran.

“Unlike past year, when the market remained in a large and steady surplus, the global oil market is now about to move into a substantial deficit”. Prior to the Brexit selloff, oil and stocks had been closely linked.

While Wednesday’s poor showing is said to have been excessive, the question now revolves around what comprises a fair price for oil, and Phil Flynn, an analyst at Price Futures Group, says, “I think $44 is a good support, as $40 or below will again deter investments”.

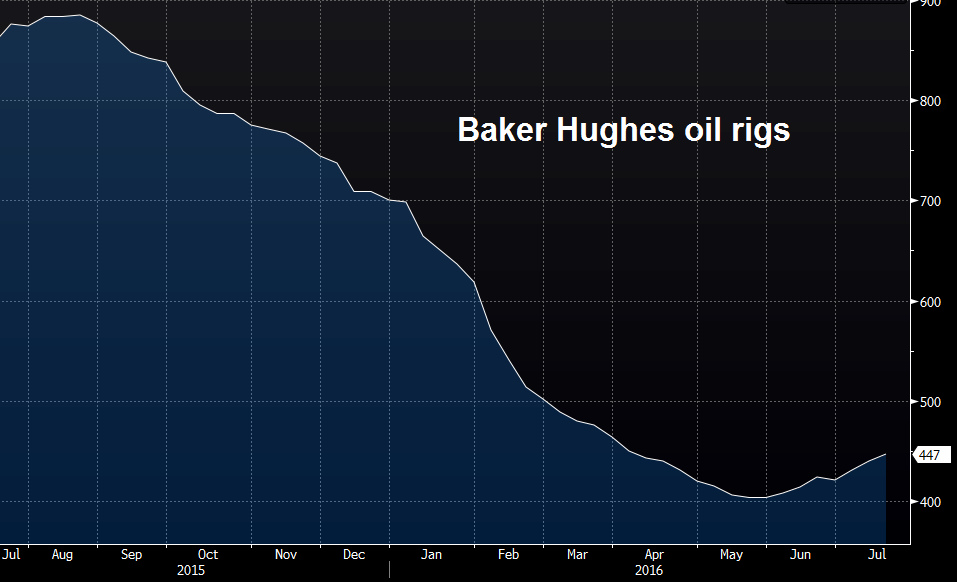

USA energy companies added six rigs drilling for oil during the week to July 15, bringing the total rig count up to 357, compared with 638 a year ago, industry firm Baker Hughes Inc said. This is due to the small losses that USO suffers when the fund rolls its exposure to active crude oil futures that are at a higher price than the expiring futures contracts in the fund.