Oil prices fall to $47 a barrel as Saudi production rises

A sustained fall in crude will test the resolve of Saudi Arabia to continue cutting production, well above its allotted limits because, after all its efforts, it is only losing market share and providing a boost to the United States shale oil industry.

West Texas Intermediate traded up 1.7 percent at $48.53 a barrel on the New York Mercantile Exchange at 1:43 p.m. Singapore time, after sliding the past seven sessions.

Brent for May settlement was unchanged at $US51.37 a barrel on the London-based ICE Futures Europe exchange.

In 2007, America imported about 60 percent of its oil, but by 2014, the U.S. only imported 27 percent of its oil – that’s the lowest level since 1985, according to the U.S. Energy Information Administration (EIA). Now, the market faces evidence that USA production remains high and global markets remain oversupplied.

In December, OPEC members and other large oil producing, including Russian Federation, to cut crude output in a bid to cut oversupply and bolster prices.

Investing.com offers an extensive set of professional tools for the financial markets.

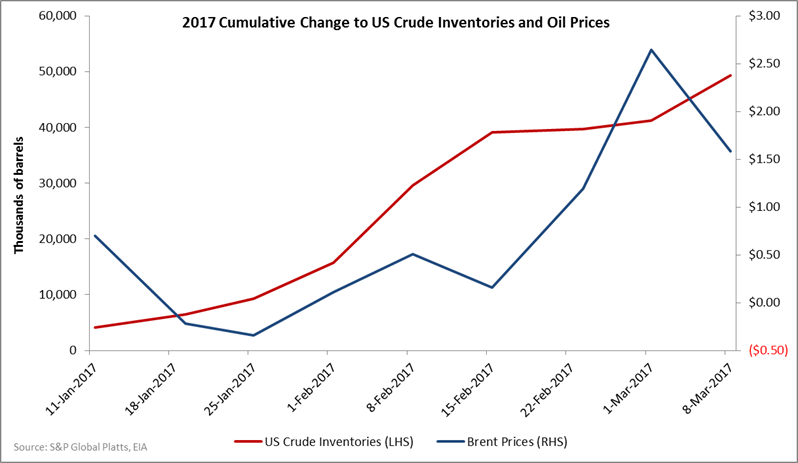

This is pretty good news, but in light of last week’s massive US inventories and the subsequent decline in prices from $54 to $47, the report isn’t enough to indicate a reversal in OPEC’s suddenly declining fortunes.

The latter were in excess of the 10.058m it was bound to under a November deal with other producers to slash their combined levels of production.

Oil tumbled on Tuesday after Opec reported a rise in global crude stocks and a surprise output jump from its biggest member, Saudi Arabia, further pressuring prices that have erased almost all of their gains since Opec announced output cuts in November.

OPEC and non-OPEC countries made a strong start to lowering their oil output by nearly 1.8 million bpd by the end of June, but so far the move has had little impact on inventory levels.

“While that figure still keeps Saudi Arabia below their individual cap, it marks a departure from their initial commitment to cut beyond what was required in order to support the deal’s overall integrity”, he said in a daily note.

For some market watchers, this could be Saudi Arabia’s tacit message to other oil producers that it is losing patience as it has been taking the lion share of the promised cut.

“The speculative community is heavily stacked to the bullish side, buoyed by OPEC’s renewed willingness to correct market oversupply”.

Senior Saudi officials told USA oil firms in a closed-door meeting they should not assume OPEC would extend output curbs to offset rising production from US shale fields, industry sources told Reuters on Thursday.

For today, investors will be watching out for the weekly USA crude production and inventories report.

Declining oil prices may put the Nigeria’s 2017 budget at risk, as deficit will rise due to fall in oil revenue for a budget, which is yet to be passed by the national assembly.

The Federal Reserve meeting also may add some uncertainty to markets, as traders await a statement from the central bank later today following its two-day policy meeting.

Complicating matters, Iraq’s oil minister said Tuesday at CERAWeek that Baghdad could raise output in the second half of 2017 to 5 million barrels a day.

USA shale oil producers appear to be enthusiastically ramping up production which will likely add do US oil inventories and further depress the price.

Data from the industry group the American Petroleum Institute on USA crude and product stockpiles is also due out later on Tuesday.