Oil prices rise as US drilling declines

According to a Baker Hughes report, the USA oil-rig count fell by eight to 644 in the latest reporting week, the third straight decline after six consecutive weeks of increases.

Plans were discussed to increase the pipeline capacity to more than 400,000 barrels per day in the future.

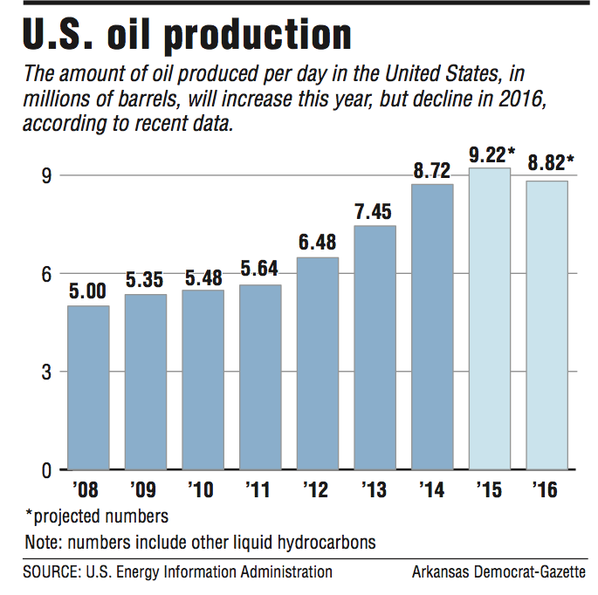

Those oil-rig reductions suggest a decline of more than 250,000 barrels per day (bpd) in U.S. crude production between the second and fourth quarters of this year, Goldman Sachs said in a report. With our revised assessment of Cushing crude stocks, we think that spring turnaround season could lead to material stock builds and as such see the potential for WTI structure to deteriorate versus the current levels, which are strongly bid on the back of current fundamentals.

The OPEC does still feel that they should protect their market share from the United States.

El Dorado-based Murphy Oil is preparing for further cuts in capital expenditures in 2016, Chief Executive Officer Roger Jenkins said during a September 11 presentation for analysts. Its market capitalization has now reached to $24.71 billion and analysts have a consensus target price of $1.61 in the 12-month period.

Saudi Oil Minister Ali Al-Naimi said in previous statements that “it is impossible” for his country to reduce its production of crude oil, despite the prices drop in the global market. In July 2015, the Senate Energy and Natural Resources Committee approved legislation sponsored by Senator Murkowski that would remove the crude oil export restrictions.

Smaller producers and companies holding a lot of debt will not survive the oil market crash, but those that do will become more efficient and productive, analysts said. Falling crude prices are starting to take its toll on US production as drilling is minimized.

West Texas Intermediate for October delivery, which expires Tuesday, was at $45.32 a barrel on the New York Mercantile Exchange, up 64 cents, at 9:30 am London time. OPEC sources also do not expect a rebound of $5 per barrel for oil prices every year, resulting in $80 by 2020.

Industry signs that weak economics may be throttling some developments in the US energy sector lifted crude oil prices in early Monday trading. The share price is now down -30.18% for the past three months. First up, its reserves continue to shrink. The U.S. Energy Information Administration doesn’t expect the Saudis or the rest of OPEC to cut production if new oil from Iran comes online. And it has a good mix of oil and natural gas production, Hanson says.

John England, deputy chairman of Deloitte’s Global Energy & Resources group, said in the company’s 2015 insights that new shale oil and deep water projects in North America could be delayed for their high cost and the dramatic decline of Brent prices.