Oil prices rise to $57 as Iran talks drag on | euronews, economy

China’s benchmark Shanghai stock index surged more than five percent in afternoon trading on Thursday, extending gains after the government issued more policies to halt a market slide, but analysts said it was unclear whether the rally would be sustained. Prices historically tend to rise as Americans head for summer vacation, but there’s just as good a chance this year that they’ll actually go down in coming months. Prices will average $62.04 next year.

It doesn’t sound like a good day to own a barrel of oil James Williams, energy economist at WTRG Economics.

The EIA predicts the shale drilling juggernaut will continue slowing under the weight of a global oil collapse.

On the New York Mercantile Exchange, light, sweet crude futures for delivery in August traded at $52.37 a barrel at 0430 GMT, up $0.72 in the Globex electronic session.

“I do not see oil prices going beyond United States dollars 80-85 a barrel (about 160 litres), given the fundamental changes in the market”.

Futures gained as much as 1 percent in New York, after climbing the most Thursday in more than two weeks.

The Greek debt crisis that could force that country out of the Eurozone or drive other European economies to come up with another bailout that in theory could destabilize other European economies – cutting demand for oil. The prolonged Greek drama has weakened the euro and is expected to for the foreseeable future. That makes dollar-denominated oil cheaper for overseas buyers. And that means cheaper gas.

Iranian exports could also resume at full throttle if major global powers and Iran find a compromise in nuclear talks this week that could lead to a lifting of western sanctions against Tehran.

Demand for oil was also supported by the return from maintenance of a 120,000 barrels per day crude distillation unit in Japan, where machinery orders hit a 7-year high in May.

Lower gasoline prices will help save drivers an additional $46 billion through the rest of the year, Kloza calculates.

Recovery on the Chinese stock market and heated exchanges on the prospects of an Iranian nuclear deal sent crude oil prices soaring early Thursday.

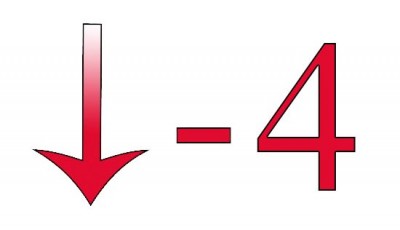

With lower oil prices, the expectation was that the country would receive significantly lower levels of revenue than originally estimated when the budget was announced by Finance Minister Larry Howai in September 2014. “So downside risk to Brent flat price persists”, Energy Aspects said on Tuesday.