Peltz’s investment fund buys stake in food distributor Sysco

Sysco Corp. rose the most in 20 months after activist investor Trian Fund Management disclosed a 7.1 percent stake in the food-distribution company and said he may seek representation on the board.

The activist hedge fund and its affiliates also paid an aggregate strike price of $712,719,181 for the additional 19,255,954 shares of Sysco that were purchased through a series of privately negotiated back-to-back call and put transactions on the same date.

Sysco jumped 7.9% in recent trading and was the best-performing stock in the S&P 500. A company spokesman says Sysco welcomes discussions with investors.

Trian declined to comment further but said in the regulatory filing that it intends to have ongoing discussions with Sysco’s management.

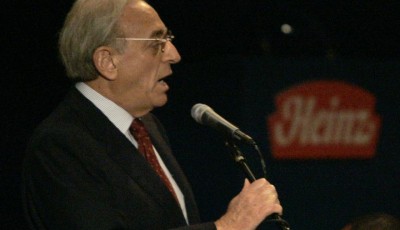

Heidi Gutman/CNBC Nelson Peltz, Founding Partner and Chief Executive Officer, Trian Fun Managementat the 5th annual CNBC Institutional Investor Delivering Alpha Conference on Wednesday, July 15, 2015.

Peltz has agitated for changes at companies including PepsiCo Inc., Mondelez worldwide Inc. and Bank of New York Mellon Corp.

Sysco is the global leader in selling, marketing and distributing food products to restaurants, healthcare and educational facilities, lodging establishments and other customers who prepare meals away from home.

The company dropped plans to buy smaller rival US Foods [USFOO.UL] for $3.5 billion in June after the Federal Trade Commission won a lawsuit to block the deal.

Sysco is in the midst of piecing together a new strategy, which it has said will involve internal cost-cutting.

Given Sysco’s performance over the past five years, it’s easy to see why Trian would perhaps see an opportunity: Shares have significantly underperformed the market, total shareholder return is less than half of the S&P over that period, and earnings-per-share are down. The main appeal of the planned acquisition of US Foods was to create savings with its larger scale that would help reverse a yearslong trend of declining profit margins.