PepsiCo Q2 Profits Rise, Revenues Beat – Business & Technology

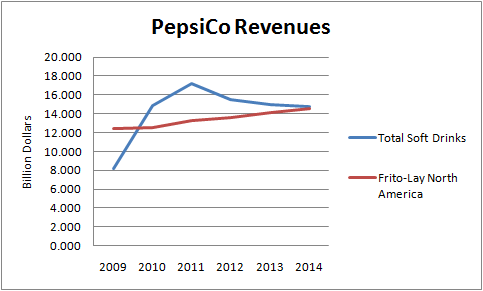

Company-wide PepsiCo reported revenue of $15.92 billion, down six percent from a year ago, based partly on foreign currency woes.

Aside from adjusting its outlook, PepsiCo has also revealed that they are on track to deliver as much as $1 billion in productivity savings.

A number of analysts have recently weighed in on PEP shares.

Net income attributable to the company rose marginally to $1.98 billion, or $1.33 per share, in the second quarter ended June 13, from $1.98 billion, or $1.29 per share, a year earlier. The fact that beverages such as sodas and juices, might continue to decline again this quarter, could add more fuel to the argument made by investors to spin-off the ailing drinks business, and let the foods division function as a separate company.

PepsiCo stock closed at $94.60, down about 1.07% yesterday, despite posting earnings upbeat. The consolidated company saw reported operating margins improve to 18.2% from 17.1% in last year’s second quarter, and management now expects core earnings per share growth of 8% (versus 7% previously).

PepsiCo, Inc. ( PEP ) is the largest food and beverage business in North America and the second largest in the world. This beat our consensus estimate of $15.81 billion. Two equities research analysts have rated the stock with a sell rating, three have given a hold rating and twelve have given a buy rating to the company’s stock. Seeking to combat consumers’ unease with artificial sweeteners, the company said in April that it would start selling Diet Pepsi without aspartame after a consumer backlash hurt sales. The stock has a consensus analyst price target of $106.15. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this link. The consensus target price stands at $105.62. The company has a market cap of $139.35 billion and a P/E ratio of 21.980. In his role, Khan leads PepsiCo’s global sustainability agenda and identifying new ways to embed sustainable business practices across all facets of the company’s business. This is a boost from PepsiCo’s previous quarterly dividend of $0.66. Through the Companys bottlers, contract manufacturers and other partners, the Company makes, markets, sells and distributes a range of foods and beverages in more than 200 countries and territories.

PepsiCo Inc. on Thursday raised its earnings forecast for the year as cost cuts and price hikes helped the snack-and-beverage giant deliver better-than-expected results in the second quarter.