Pound surges after inflation breaches Bank of England’s target — FX Focus

UK CPI Inflation today has been announced at 2.3%, new independent research from Barclays Business reveals small business costs rose 3.2% in the year to February 2017, meaning SMEs are now facing higher effective rates of inflation than households.

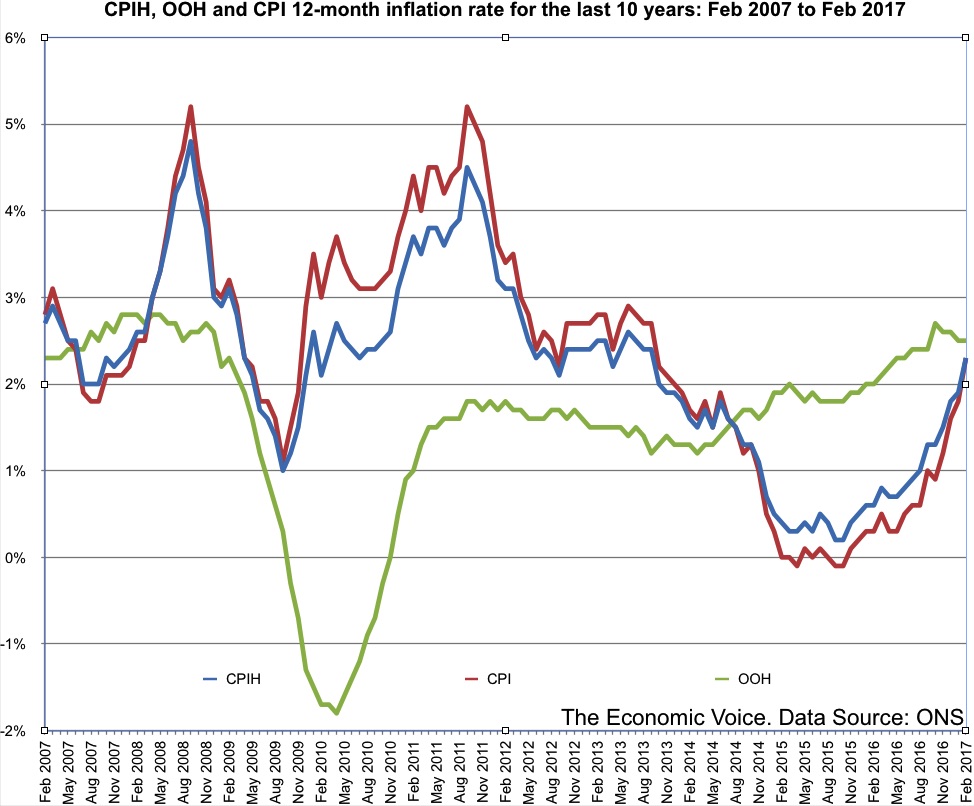

CPIH – which includes CPI and owner occupiers housing costs – also hit 2.3% in the month, up from 1.9% in January.

Worryingly, there could be more pain to come as the Bank of England has predicted inflation could peak at around 2.8%.

The news, which could be perceived as increasing the possibility of an interest rate hike from the Bank of England, pushed sterling substantially upwards, with the currency climbing to a level not seen since late February. But the minutes of its meeting last week suggested a split was emerging over how much inflation should be tolerated before taking borrowing costs higher again from their current record low of 0.25%.

– The data increase the likelihood of an interest rate hike from the Bank of England to combat higher prices. With rising food and fuel prices set to push inflation above 3% by the end of the year, 2017 looks set to be an increasingly tough year for households’. Output prices climbed 3.7% year-on-year, in line with expectations and the eighth consecutive increase. Investment recovery is vital to resolving the UK’s productivity stagnation since 2008, which underlies the lack of real wage growth.

Inflation has surged to its highest level for three and a half years adding to fears of a squeeze on households as wage growth stalls. The Bank of England expects growth to remain modest, and the most recent labor-market data showed it cooled to 2.3 percent in the quarter through January from 2.6 percent. “We don’t expect any change in Bank rate before the end of 2018”.

TUC general secretary, Frances O’Grady, said: “Working people across the United Kingdom are now facing the double blow of rising prices and slower wage growth”. Although experience tells us that there could still be some substantial revisions to the historical data over the coming months. The lack of any element of housing costs in CPI can not be unrelated to the feeble response of the Blair, Brown and Cameron governments to tackle high house price inflation.

Likewise, core inflation that excludes energy, food, alcoholic beverages and tobacco prices, rose to 2 percent from 1.6 percent in January.

The problem with rising inflation is that it erodes the real term value of savings, and with cash interest rates so low, savers may want to consider investing in order to beat rising inflation. “Today’s inflation bulletin from the ONS feels somewhat like Groundhog Day, as the fall in sterling continues to make its way through to the high street”, he says.

But the rise in inflation, even if temporary, also brings dangers for that recovery.

Month-on-month, consumer prices grew 0.7 percent in February, faster than the expected 0.5 percent increase.

Consumer prices leapt 2.3 percent, their biggest increase since September 2013 and up sharply from 1.8 percent in January, the Office for National Statistics said.