Qatar to invest $35b in U.S. with New York office

Qatar doesn’t reveal the size of its assets, but the London-based Sovereign Wealth Fund Institute estimates its holdings at $256 billion, making it the ninth largest in the world while Abu Dhabi’s ADIA ranks second with $773 billion.

The news comes as the Qatar fund said it would be investing up to $35bn in the United States over the next five years – five times the amount it has done so far in its history – following the opening of a USA office, according to sources quoted by the paper.

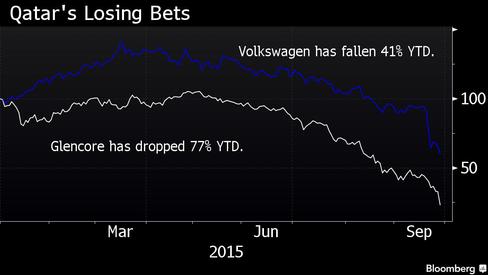

QIA said the New York office would give it better access to new and existing public and private sector investment partners and “illustrate its confident outlook in the USA and wider Americas”. The Qatar sovereign fund invested several global majors such as British bank Barclays Plc to Volkswagen AG, which is reeling under severe pressure over the rigging charges in emission tests results.

However, the sovereign fund will continue to stay committed on Europe, Asia and the Middle East markets.

With world economies, markets and currencies often moving in different cycles and rhythms, the importance of a globally diversified investment portfolio is central to QIA.

The QIA’s existing American holdings include a more than 10-percent stake in New York-based luxury jeweler Tiffany & Co. QIA has stakes in Paris Saint-Germain soccer team.

Last year, the QIA, which has about $334 billion of assets according to industry tracker Sovereign Wealth Centre, said it planned to set up a $10 billion investment venture with China’s Citic Group to diversify from retail and property assets in Europe.

The Qatar Investment Authority was founded by the State of Qatar in 2005 following the vision of Sheikh Hamad Bin Khalifa Al Thani to strengthen the country’s economy by diversifying into new asset classes. The wealth fund is also the largest investor in the mining company Glencore, a stake that declined by about $1.1 billion in the same period.