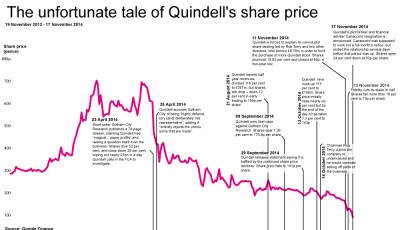

Quindell shares dive 30% on SFO probe and £238m loss

On Wednesday, Quindell posted a huge pretax loss in its delayed 2014 results after it changed its accounting policies to book revenue later in the “client service cycle”, saying revenue and profit will now be recognised, in the majority of cases, when liability is admitted by the at-fault insurer.

On Wednesday, Quindell re-published its 2014 annual report after making “substantial restatements of prior year revenues, profits and net assets”, according to the Financial Reporting Council, the United Kingdom accounting regulator.

Britain’s anti-fraud agency has launched an investigation into business and accounting practices at insurance claims processor Quindell, it said yesterday, as the company announced a 238 million pound (372 million dollar) loss for 2014.

The Serious Fraud Office (SFO) has opened a criminal investigation into business and accounting practices at Hampshire-based Quindell. It forecast revenue to remain largely flat in 2015, compared with 72 million pounds for 2014.

The financial impact of the change in accounting policy for the professional services division operation, treated as a discontinued operation in Quindell’s report, is stark.

The stock had been suspended since June 24, when the troubled insurance outsourcer informed shareholders that the Financial Conduct Authority had started a probe into statements it had made about its accounts. Quindell appointed PricewaterhouseCoopers in December to help review cash flows, business plans and accounting policies after the ouster of its founder in November.

The PSD, mostly handling personal injury but also includes marketing and motor services, employs around 1,400 staff, and operates under a range of brands including Silverbeck Rymer, Pinto Potts and The Compensation Lawyers, while the complementary services has around 1,000 staff members. A variety of factors led the business to become destabilised.’. The watchdog, which said yesterday it had closed part of its probe, is still investigating individuals and two of the company’s auditors. A great deal has been done in a short space of time to turn the tide, and I am confident in the company’s long-term future and the potential of our businesses.’. The SFO declined to comment beyond confirming the investigation. You need JavaScript enabled to view it.