Record Profit for Disney in Q3

Walt Disney Co (NYSE:DIS) revenue missed Wall Street expectations for the first time in eight quarters, despite the success of “Avengers: Age of Ultron“. Following the release of earnings report, shares were initially down 2.1% at $119.17 in the after-hours trading session.

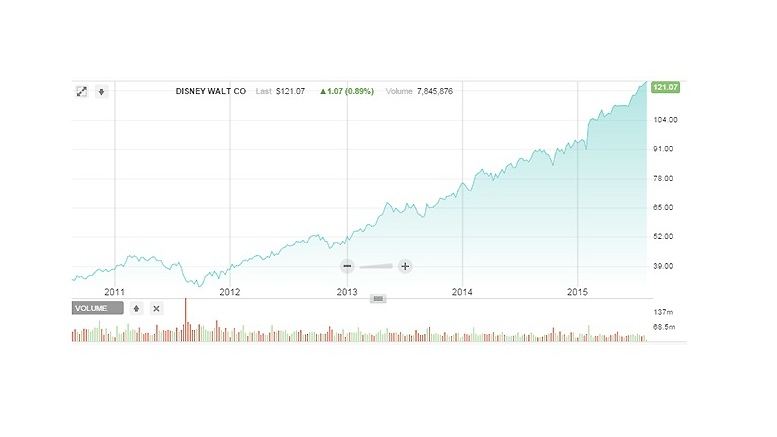

The company’s shares, which had risen nearly 30% over the year to date, lost 6.5% of their value in late trading following the release of the results and Disney’s conference call with analysts.

Investors were spooked earlier this week after executives at Disney told analysts that its key cable networks group would fall short of previous earnings estimates for next year.

Disney’s movie studio has seen a 15 per cent increase in operating income on the comparable period last time, hitting $472million.

The company’s popular parks and resorts saw revenues go up 4% in the quarter while its media networks increased 5%.

Walt Disney reported net income of $2.5 billion for the third quarter, setting a new quarterly record, but its shares dropped amid disappointment over revenue.

The company lowered its outlook for its cable networks to grow earnings before interest and taxes to mid-single digit growth, primarily due to weakness at ESPN, but Banks noted that the weakness here has been overlooked by investors in the past.

“The increase in volumes was due to attendance growth at our theme parks and higher occupied room nights at Walt Disney World Resort and our Aulani resort in Hawaii”.

Near 1645 GMT, shares of the media and entertainment giant were off 9.0 per cent at US$110.68 after closing at a 52-week high on Tuesday.

Interactive revenues fell 22 percent to $208 million, with the division posting a $29 million operating income.

Operating income at the TV networks division rose 4% to $2.38 billion thanks to a better performance from the Disney Channel, Disney’s ABC Family network and ESPN.

Revenue rose to $13.10 billion in the quarter ended June 27, from $12.47 billion, shy of the $13.23 billion projected by industry analysts. Analysts had set their sights at $13.2 billion.