Royal Dutch Shell plc Now Covered by BMO Capital Markets (RDS/A)

The total number of A shares and B shares in issue is 6,382,291,619 and this figure may be used by shareholders as the denominator for the calculation by which they will determine if they are required to notify their interest in, or a change to their interest in, Royal Dutch Shell plc under the FCA’s Disclosure and Transparency Rules.

Over the past year, N/A per share in dividends to investors.

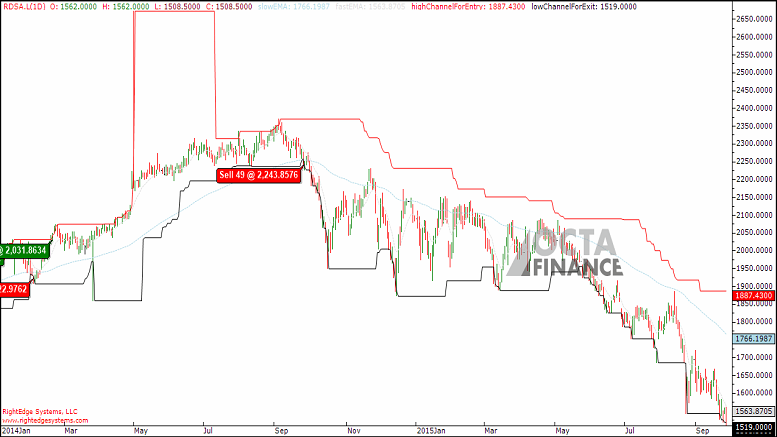

Royal Dutch Shell (RDS.B – Get Report) shares are rallying 2.18% to $46.92 on Tuesday afternoon along with rising oil prices as positive economic data gave USA equity markets, including oil futures, a boost. The stock presently has a consensus rating of Buy and a consensus price target of GBX 2,052.37 ($31.20). This is the arithmetic average based on the N/A analysts who have issued projections over the past year. The stock’s 50 day moving average is GBX 1,660.57 and its 200-day moving average is GBX 1,870.94. BNP Paribas reissued an outperform rating and set a GBX 2,290 ($34.81) price target on shares of Royal Dutch Shell Plc in a report on Saturday, July 18th.

Royal Dutch Shell plc (Shell) is an independent oil and gas company. S&P Capital IQ redesigned its rating on the 201.71 billion GBP business sector top organization to “Purchase”. Royal Dutch Shell’s stock is down -30.58% in the past 200 days. Citigroup Inc. reiterated a neutral rating and issued a GBX 1,975 ($30.02) price target on shares of Royal Dutch Shell Plc in a research note on Tuesday, September 8th. The Organization operates in three segments: Corporate, Downstream and Upstream. In the last 50 and 100 days, Royal Dutch Shell is down 17.07% and down 25.36%, separately.

This news comes after the oil and gas company said on Monday that it would abandon its search for oil off of Alaska’s northern coast due to disappointing results, the Wall Street Journal added.

Crude oil (WTI) is jumping 2.27% to $45.44 per barrel and Brent crude is also rising 2.2% to $48.38 per barrel, according to the CNBC.com index. The Company’s Upstream global business manages Shell’s Upstream activities outside the Americas. Downstream segment is engaged in manufacturing, distribution and advertising activities for petroleum products and substances, alternative energy (excluding wind), and carbon dioxide (CO2) direction.