Saudi Arabia’s Crude Oil Production Rose: Will Prices Fall More?

They were hoping for oil prices to stay above $50 this year – a level high enough to keep government coffers full, but low enough to discourage American shale producers from restarting their operations.

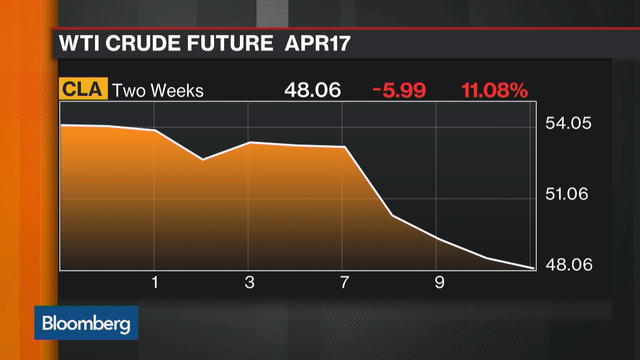

The price for benchmark USA oil fell more than $1 US Tuesday in North American trading amid reports that Saudi crude production rose last month.

The production increase inched Nigeria closer to Angola which still remains Africa’s largest oil producer, despite recording a drop in output.

The result: WTI has tumbled following the OPEC report and Kuwait statement. In the meantime, the technical picture still looks weak and further downside can not be ruled out.

For the United States, the world’s leading economy, it’s seen a “triple surge” in supplies in part because of rising imports.

At first glance, the data looked like good news for the agreement the cartel made with some major non-OPEC producers late past year that would trim overall production by roughly 1.8 million barrels a day. Data showed on Tuesday that oil inventories had risen despite the deal to cut supply.

“The focus on Saudi Arabia pushing production back to 10 million bpd after cutting beyond the call of duty in January is a key driver”, Harry Tchilinguirian, global head of oil strategy at BNP Paribas, told Reuters Global Oil Forum.

USA inventories have climbed more than expected, causing prices to decline even as global producers cut their output, Kuwait’s Oil Minister Issam Almarzooq said, according to official news agency Kuna. We could see prices firm if OPEC announces it is considering an extension. The Opec and IEA monthly reports due this week will give better understanding about the level of compliance. Brazil’s oil exports also have been climbing with February exports at a record 1.63 mbpd. “As long as OPEC stays on track and non-OPEC delivers on their agreed cuts the market will continue to balance”, he said. Members Nigeria and Libya were exempt from making reductions. Federal estimates on production this year showed gains are expected, a reversal from forecasts late last year.

The jump meant Iran replaced regional rival Iraq as India’s second-biggest oil supplier – a role Tehran used to occupy before Western sanctions were imposed against it over the country’s disputed nuclear program. EIA data shows in the latest week, US output hit a 13-month high at 9.1 million barrels a day. Both were at their lowest prices since November.

OPEC increased output by 170,000 bpd to 32 million bpd and non-OPEC oil production increased by 90,000 bpd to 57.8 million bpd, largely due to higher USA output. “The official crude inventory numbers will be important”. Gasoline and Distillate stocks are also near the upper end of the five-year range.