Significant Movements: Marathon Oil Corporation (NYSE:MRO)

According to consensus agreement of 29 analysts Anadarko Petroleum Corporation (NYSE:APC) will report earnings per share of $-0.17 in their quarterly report and it is expected to announce the company’s results on 5/1/17. For the past 5 years, the company’s revenue has grown 3.5%, while the company’s earnings per share has grown 12.7%.

EPS growth in past 5 year was -25.30% along with sales growth of -22.40% in the last five years.

Now the return on equity is -11.40% and its debt to equity is 0.41.

As the revenues measures, firm has operation margin of -35.00% in the following twelve months with net profit margin of negative -39.10%.

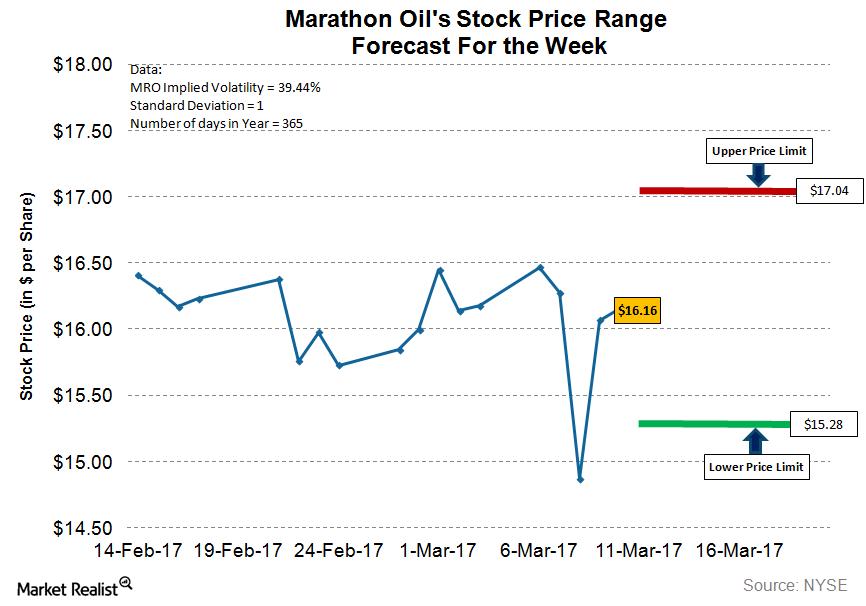

After seeing a strong 56% rise from the beginning of November 2016 to mid-December 2016, Marathon Oil (MRO) appears to have consolidated its gains since mid-December. Royal Bank of Canada now has a sector perform rating on the stock. The monthly performance is 2.08% and the yearly performance is 54.74%. The stock has a weekly performance of -2.64 percent and is -4.78 percent year-to-date as of the recent close. MARATHON OIL CORPORATION (MRO) has received mean Analyst rating of 2.28 from polled analysts at Reuters recently.

In the trailing 12 months period, return on assets ratio of the Company was -6.60% and return on equity ratio was -11.40% while its return on investment ratio was -7.30%. In last quarter ended 2016-12-31, Anadarko Petroleum Corporation earnings came at $-0.5 suggesting a deviation of -0.02. The Return on Equity (ROE) value stands at -11.4%. The stock is now trading -5.49% below its SMA 50 and 2.42% above its SMA 200. Last session Marathon Oil Corporation RSI was seen at 41.12. Marathon Oil Corporation P/E (price to earnings) ratio is 0 and Forward P/E ratio of 63.83. The latest reports which are outstanding on Wednesday 15th of March state 7 analysts have a rating of “strong buy”, 6 analysts “buy”, 14 analysts “neutral”, 1 analysts “sell” and 0 analysts “strong sell”. The share price is now up 14.83% for the past three months. But the major point is that market analysts’ statements on profits and securities move prices.

Liquidity ratios helps investors to determine a company’s ability to pay off its debts. With an institutional ownership near 77.7%, it carries an earnings per share ratio of 3.22. The stock was purchased at an average cost of $49.94 per share, with a total value of $99,880.00. Marathon Oil has a one year low of $9.65 and a one year high of $19.28. The stock’s market capitalization is $13.42 billion.

Volume is the amount of shares that trade hands – in simple terms.

Marathon Oil Corporation is an exploration and production (E&P) company. Average True Range (ATR) is an indicator based on trading ranges smoothed by an N-period exponential moving average percentage of the true range values. Analysts have a mean recommendation of 2.60 on this stock (A rating of less than 2 means buy, “hold” within the 3 range, “sell” within the 4 range, and “strong sell” within the 5 range). The firm has a 50-day moving average of $16.34 and a 200-day moving average of $16.11. Shorter SMAs are used for short-term trading and vice versa. Investors can use these support and resistance levels to refine their entries and exits from stocks. That means, once accounting for this transaction, the Director is left with a stake of 171,079 shares, carrying a current total market value of $10574393.

Best time to invest in stock market is when things are on odd side, and it’s not easy how to pick stocks. The RSI is considered to be an internal strength indicator, not to be confused with relative strength which is compared to other stocks and indices. It is the amount of uncertainty or riskabout the magnitude of changes in a stock’s value. Examples of analysis performed within this article are only examples. Assumptions made within the analysis are not reflective of the position of any analysts or financial professionals.